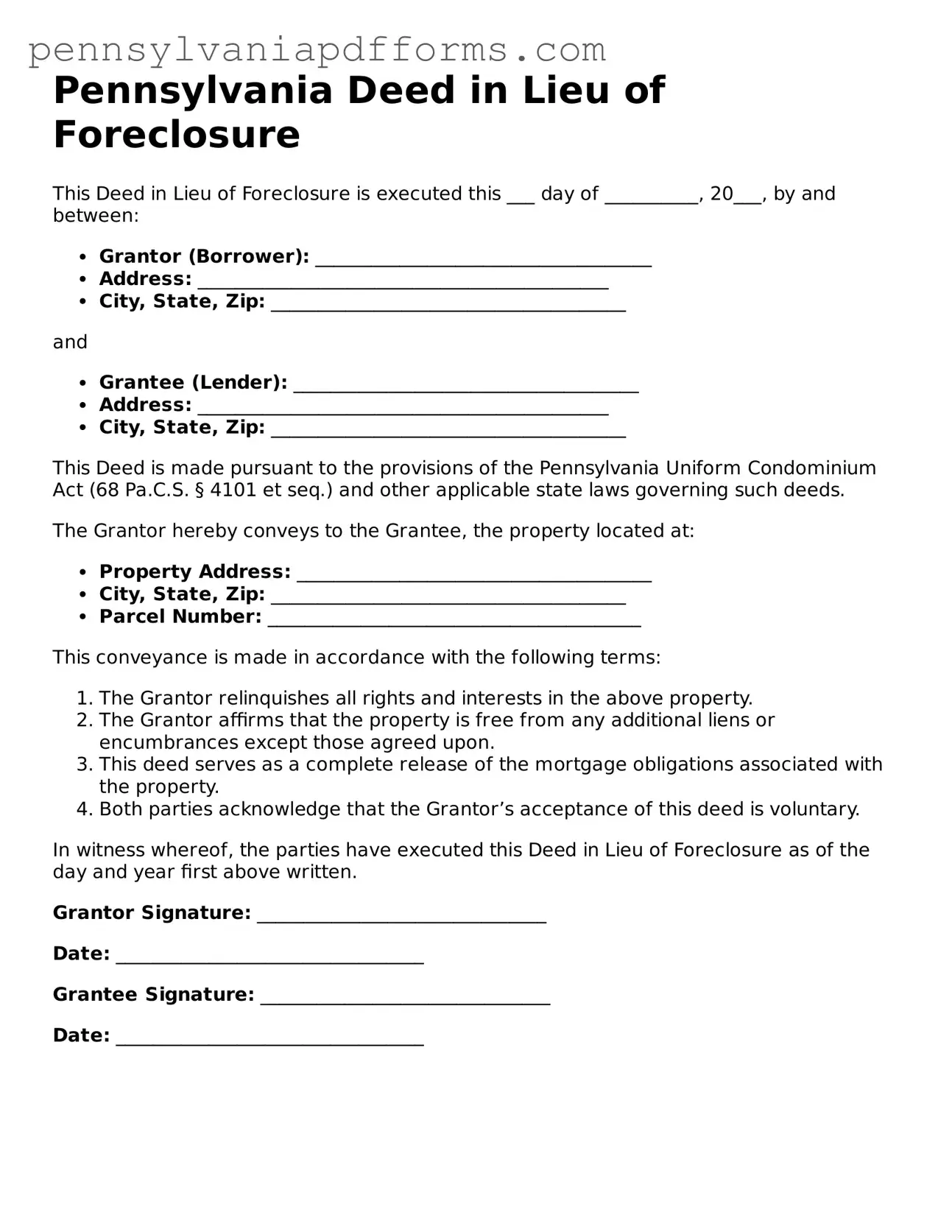

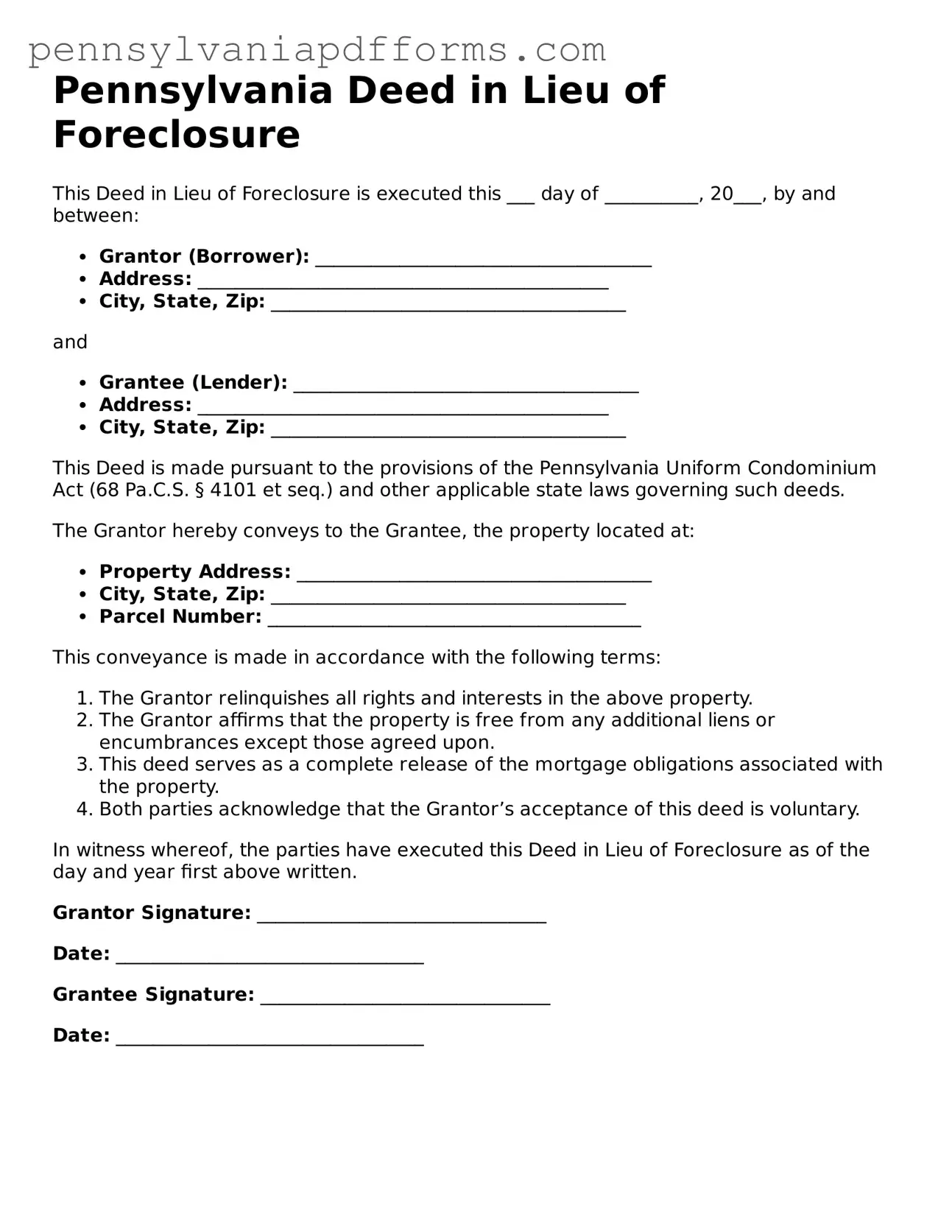

Fillable Deed in Lieu of Foreclosure Document for Pennsylvania State

The Pennsylvania Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer ownership of their property to the lender as a way to avoid foreclosure. This process can provide a more amicable resolution for both parties, often alleviating the stress and financial burden associated with foreclosure proceedings. If you're considering this option, you can fill out the form by clicking the button below.

Access Editor Now

Fillable Deed in Lieu of Foreclosure Document for Pennsylvania State

Access Editor Now

Almost there — finish the form

Complete Deed in Lieu of Foreclosure online in minutes, fully online.

Access Editor Now

or

➤ Deed in Lieu of Foreclosure File