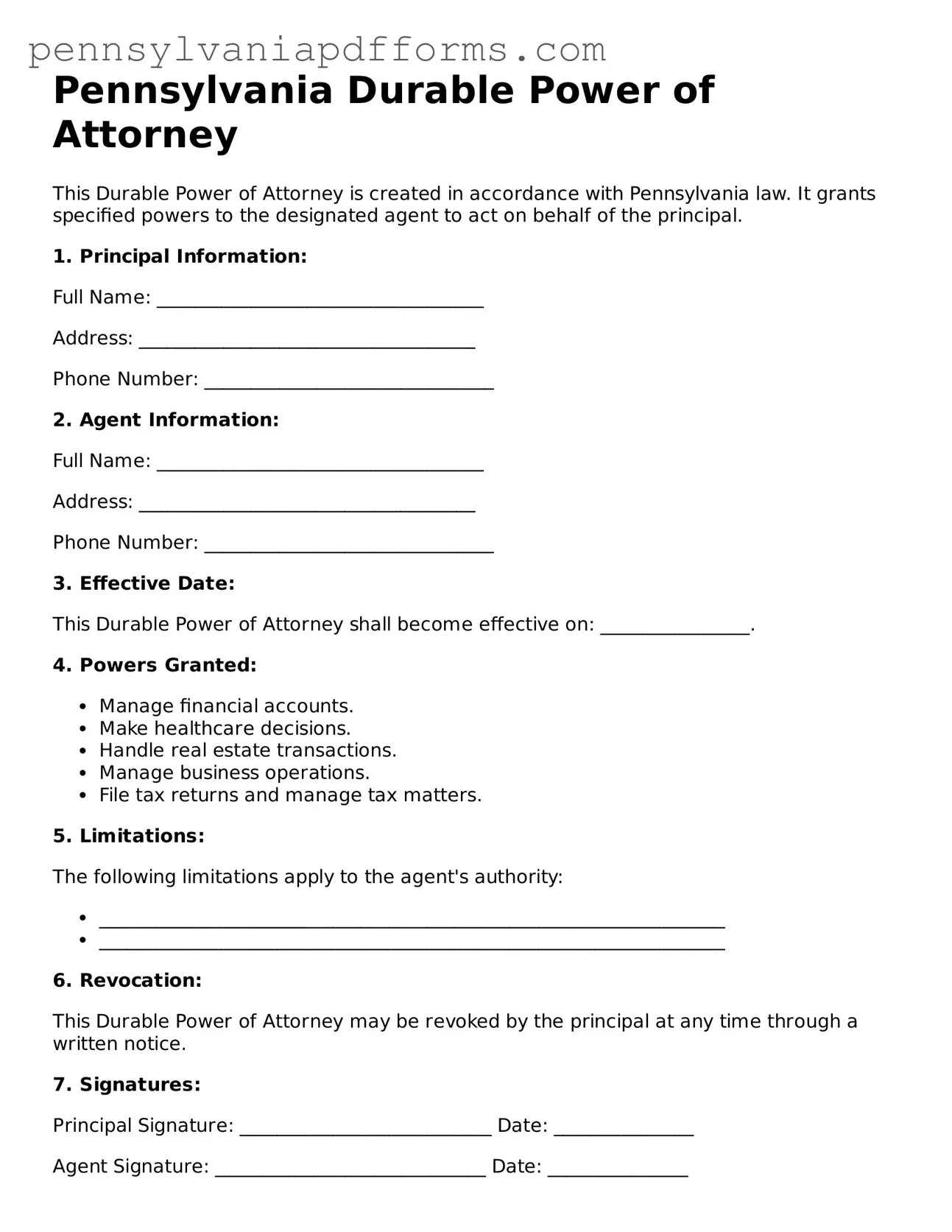

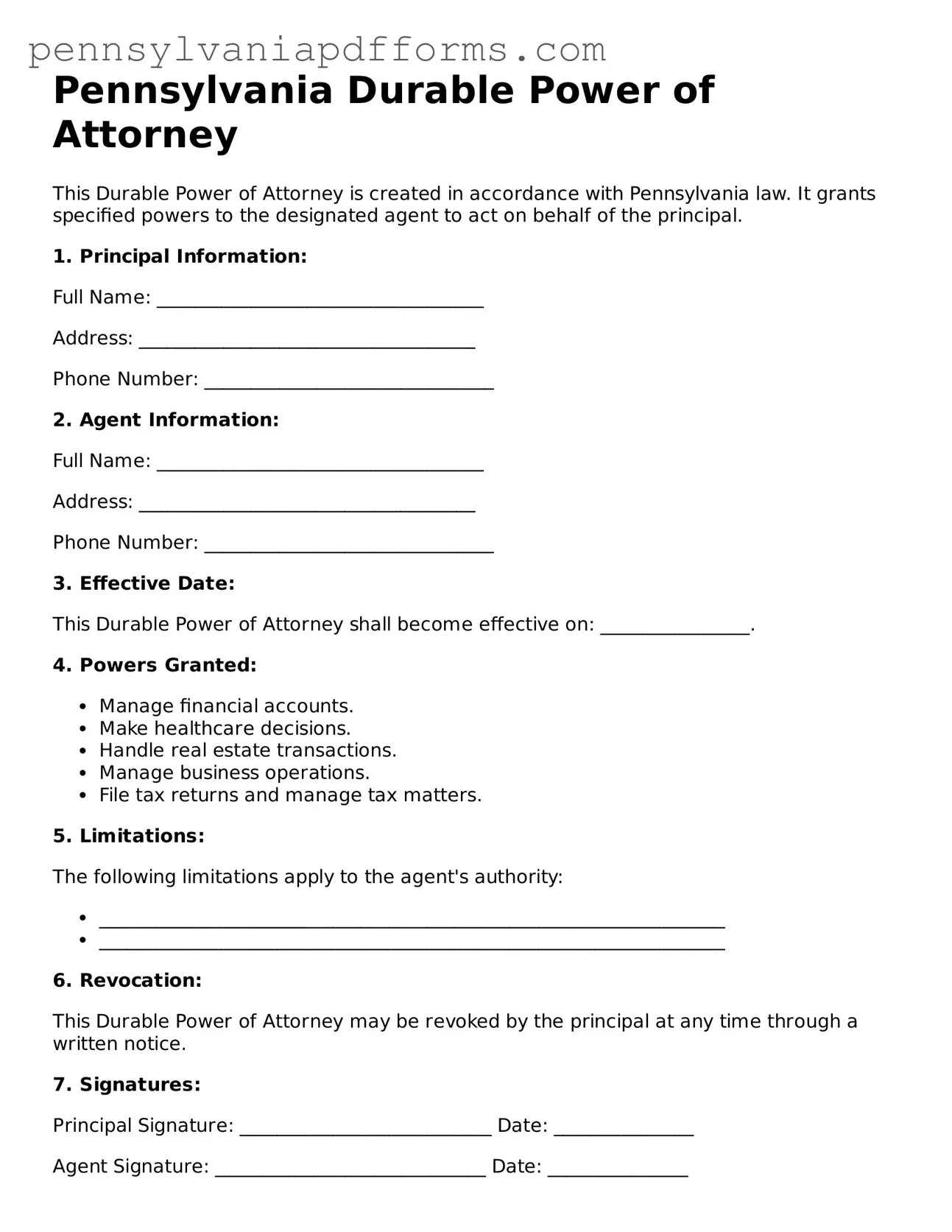

Fillable Durable Power of Attorney Document for Pennsylvania State

A Pennsylvania Durable Power of Attorney form is a legal document that allows you to designate someone to make financial and legal decisions on your behalf, even if you become incapacitated. This form ensures that your wishes are respected and that your affairs are managed by a trusted individual. If you’re ready to take this important step, fill out the form by clicking the button below.

Access Editor Now

Fillable Durable Power of Attorney Document for Pennsylvania State

Access Editor Now

Almost there — finish the form

Complete Durable Power of Attorney online in minutes, fully online.

Access Editor Now

or

➤ Durable Power of Attorney File