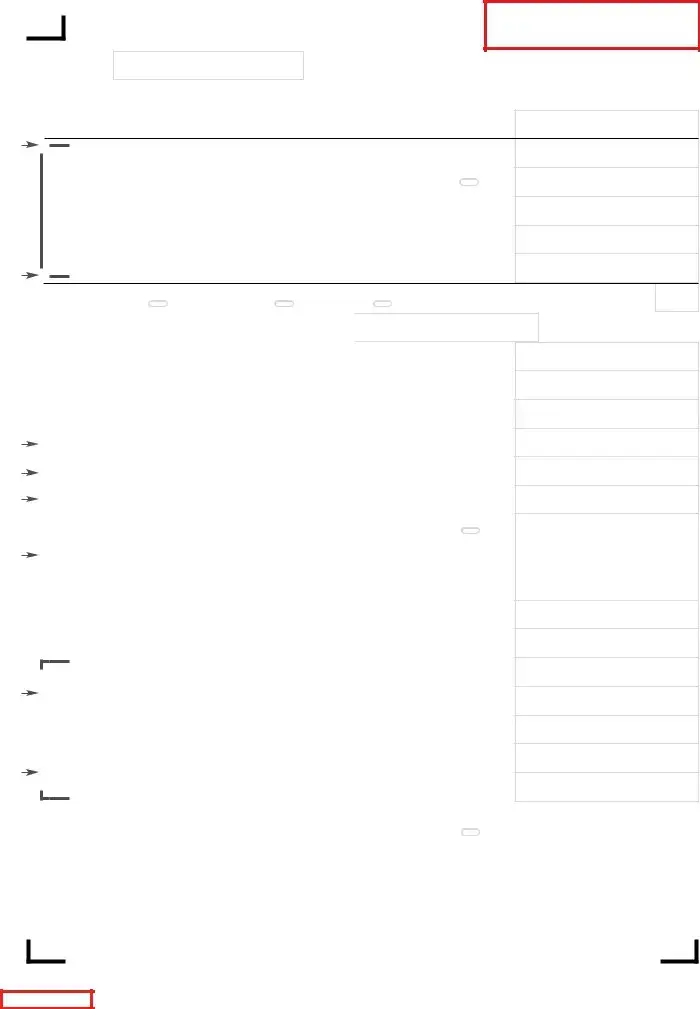

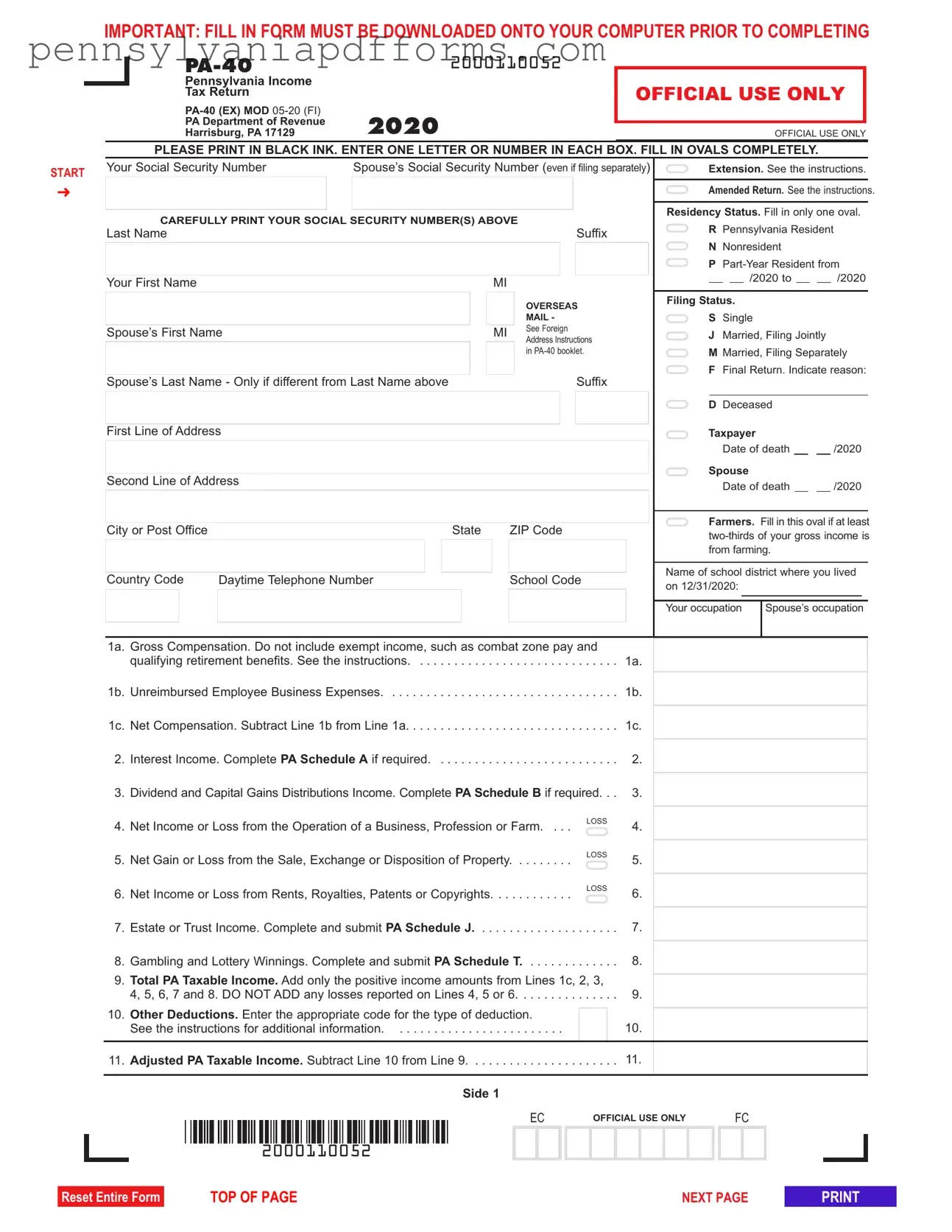

The PA-40 Tax Form is similar to the IRS Form 1040, which is the standard individual income tax return used by U.S. taxpayers. Both forms require personal information, including Social Security numbers, and detail income from various sources. Just like the PA-40, the 1040 allows taxpayers to report wages, dividends, and capital gains. Each form also includes sections for deductions and credits, which can reduce overall tax liability. While the PA-40 is specific to Pennsylvania residents, the 1040 is used nationwide, making it a foundational document for income tax reporting.

Another document that shares similarities with the PA-40 is the IRS Form 1040A. This form was designed for taxpayers with simpler tax situations and allows for the reporting of wages, salaries, and certain types of income. Like the PA-40, the 1040A includes sections for claiming deductions and credits. However, the 1040A has fewer lines and is less complex than the full 1040, making it easier for individuals who do not itemize deductions. Both forms ultimately aim to determine tax liability based on reported income.

The PA-40 also resembles the IRS Form 1040EZ, which is the simplest tax form for individuals with basic tax situations. Similar to the PA-40, the 1040EZ requires minimal information and is designed for those with straightforward income sources. Both forms require taxpayers to provide their filing status and personal information. While the 1040EZ is limited to single and married filing jointly statuses, the PA-40 accommodates various residency statuses, reflecting the specific needs of Pennsylvania taxpayers.

The PA-40 has parallels with the New Jersey NJ-1040 form. Both forms serve as state income tax returns and require similar information regarding personal details and income sources. Each form also includes sections for deductions and credits specific to the respective state’s tax laws. While the PA-40 is tailored for Pennsylvania residents, the NJ-1040 is designed for New Jersey residents, highlighting the unique tax regulations in each state.

Another comparable document is the California Form 540. This form is used by California residents to report their income and calculate state tax liability. Like the PA-40, the Form 540 includes sections for various income types, deductions, and credits. Both forms aim to ensure that taxpayers accurately report their financial information while adhering to state tax regulations. The similarities in structure and purpose illustrate how different states manage income tax reporting.

The Massachusetts Form 1 is another tax document that bears resemblance to the PA-40. This form is used by Massachusetts residents for their state income tax returns and requires similar information regarding personal identification and income. Both forms allow for the reporting of various income types and include sections for deductions and credits. The structure of each form reflects the states' requirements for accurately reporting tax information while considering local tax laws.

Understanding various tax forms is crucial for Pennsylvania residents to navigate their tax obligations effectively. For instance, the Ohio Lease Agreement form is a legal document used by landlords and tenants to outline the terms and conditions of renting a residential property, ensuring clarity on responsibilities and payment terms. Resources such as PDF Document Service can provide templates to facilitate this understanding, thus aiding in a smoother renting experience for both parties involved.

The New York State IT-201 form is similar to the PA-40 in that it serves as a personal income tax return for New York residents. Both forms require taxpayers to provide personal information, income details, and any applicable deductions or credits. The IT-201 and PA-40 both aim to determine the taxpayer's liability based on reported income, showcasing the common elements found in state tax forms across the U.S.

Lastly, the Illinois IL-1040 form shares characteristics with the PA-40. This form is used by Illinois residents to file their state income tax returns. Similar to the PA-40, the IL-1040 requires personal information and details regarding various income sources. Each form also includes sections for deductions and credits, allowing taxpayers to reduce their tax liabilities. The IL-1040, like the PA-40, reflects the specific tax laws and regulations of its respective state.

R

R  N

N