Filling out the Pennsylvania New Hire form may seem straightforward, but many people make common mistakes that can lead to delays or complications. Here are ten mistakes to watch out for when completing this important document.

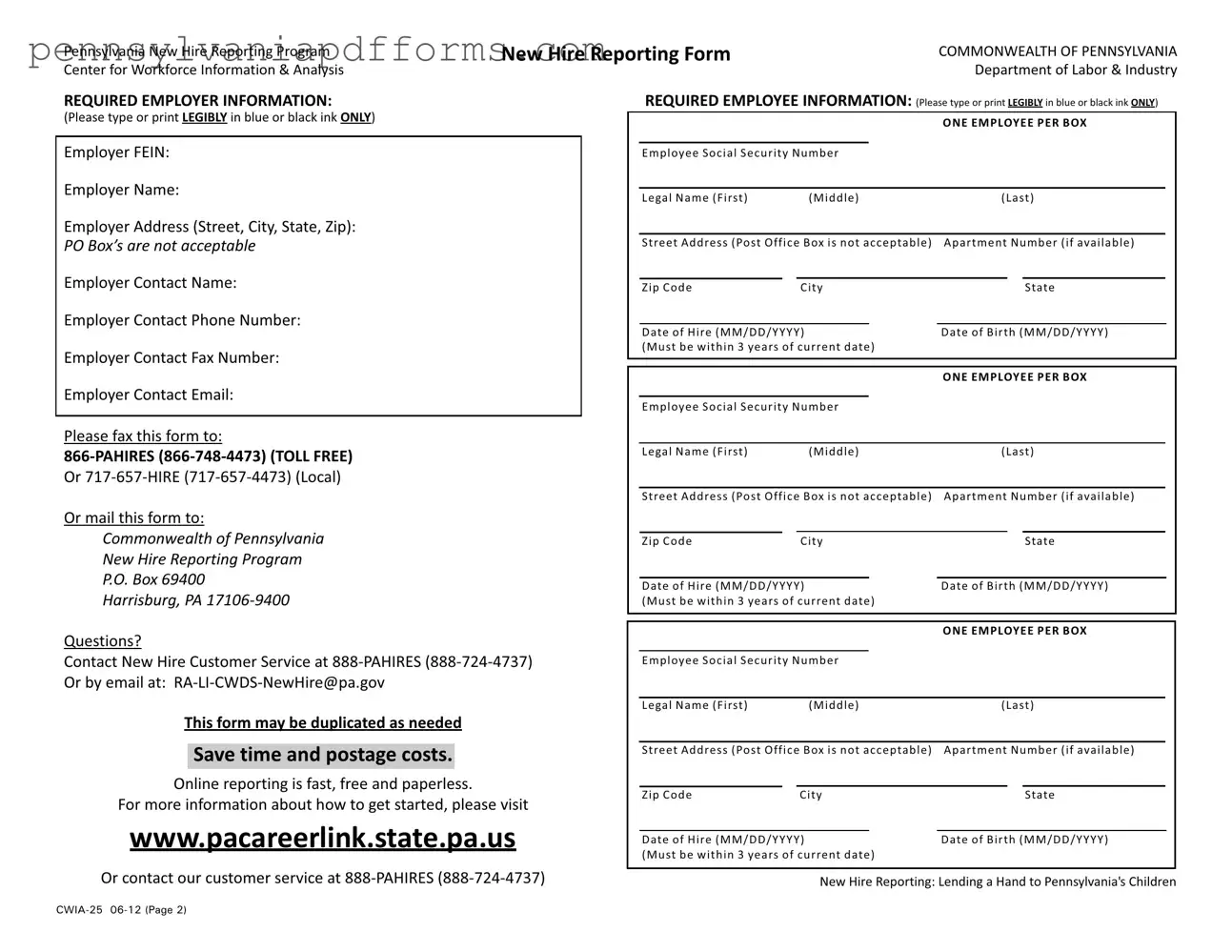

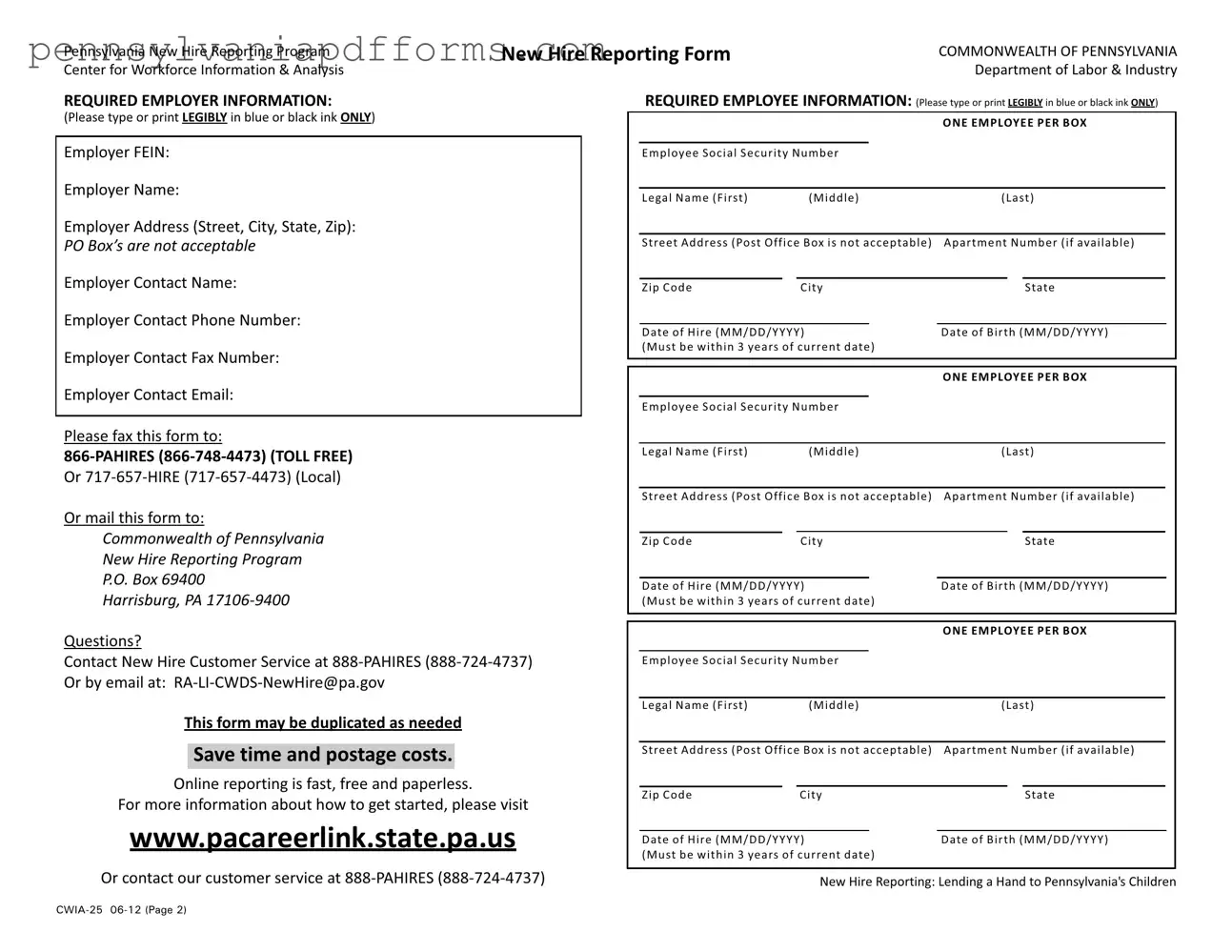

First, one of the most frequent errors is failing to provide the correct Employer FEIN. This number is crucial for identifying your business. Double-check that you have the right Federal Employer Identification Number to avoid any issues.

Another common mistake is not using legible handwriting. The instructions clearly state that the form should be filled out in blue or black ink, and it must be legible. If the information is hard to read, it could lead to processing delays.

Many individuals also forget to include the employee's Social Security Number. This number is essential for tax purposes and must be accurate. Omitting it can result in significant issues down the line.

Some people mistakenly provide a PO Box address for the employer or employee. The form specifically states that PO Boxes are not acceptable. Always use a physical street address to ensure compliance.

Another oversight occurs with the Date of Hire and Date of Birth fields. These dates must be formatted correctly as MM/DD/YYYY. Errors in date formatting can lead to confusion and processing delays.

Additionally, individuals often neglect to fill out the Apartment Number section when applicable. If the employee lives in an apartment, this information is necessary for accurate address verification.

It’s also important to remember that the Employer Contact Information should be complete. This includes the contact name, phone number, and email address. Incomplete contact details can hinder communication if questions arise during processing.

Many people do not verify the legality of the employee's name as it appears on their identification. Ensure that the legal name matches the name on the Social Security card to avoid discrepancies.

Another common error is failing to sign or date the form. The form requires a signature to validate the information provided. Without it, the form may be considered incomplete.

Lastly, some individuals do not take advantage of online reporting options. The Pennsylvania New Hire Reporting Program offers a fast, free, and paperless way to submit this information. Utilizing this option can save time and reduce the likelihood of errors.

By being aware of these common mistakes, you can ensure that your Pennsylvania New Hire form is completed accurately and efficiently. This not only helps you comply with state regulations but also streamlines the onboarding process for new employees.