THE NOTARIZATION MUST BE COMPLETED ON FIRST AND LAST SUBMISSIONS ONLY. ALL OTHER INFORMATION MUST BE COMPLETED WEEKLY.

*FRINGE BENEFITS EXPLANATION (FB): Bona fide benefits contribution, except those required by Federal or State Law (unemployment tax, workers’ compensation, income taxes, etc.)

Please specify the type of benefits provided and contributions per hour:

1)Medical or hospital care __________________________________________________________________________

2)Pension or retirement ____________________________________________________________________________

3)Life insurance _________________________________________________________________________________

4)Disability _____________________________________________________________________________________

5)Vacation, holiday _______________________________________________________________________________

6)Other (please specify) ___________________________________________________________________________

CERTIFIED STATEMENT OF COMPLIANCE

1.The undersigned, having executed a contract with _____________________________________________________

(AWARDING AGENCY, CONTRACTOR OR SUBCONTRACTOR)

______________________________ for the construction of the above-identified project, acknowledges that:

(a)The prevailing wage requirements and the predetermined rates are included in the aforesaid contract.

(b)Correction of any infractions of the aforesaid conditions is the contractor’s or subcontractor’s responsibility.

(c)It is the contractor’s responsibility to include the Prevailing Wage requirements and the predetermined rates in any subcontract or lower tier subcontract for this project.

2.The undersigned certifies that:

(a)Neither he nor his firm, nor any firm, corporation or partnership in which he or his firm has an interest is debarred by the Secretary of Labor and Industry pursuant to Section 11(e) of the PA Prevailing Wage Act, Act of August 15, 1961, P.L. 987 as amended, 43 P.S.§ 165-11(e).

(b)No part of this contract has been or will be subcontracted to any subcontractor if such subcontractor or any firm, corporation or partnership in which such subcontractor has an interest is debarred pursuant to the aforementioned statute.

3.The undersigned certifies that:

(a)the legal name and the business address of the contractor or subcontractor are: _________________________

_________________________________________________________________________________________

|

|

|

|

(b) The undersigned is: |

a single proprietorship |

a corporation organized in the state of ______________ |

|

a partnership |

other organization (describe) ____________________________ |

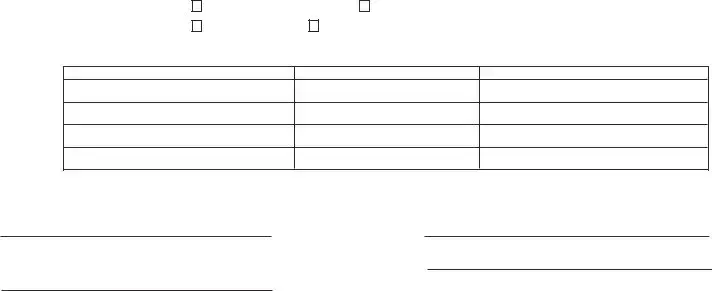

(c)The name, title and address of the owner, partners or officers of the contractor/subcontractor are: