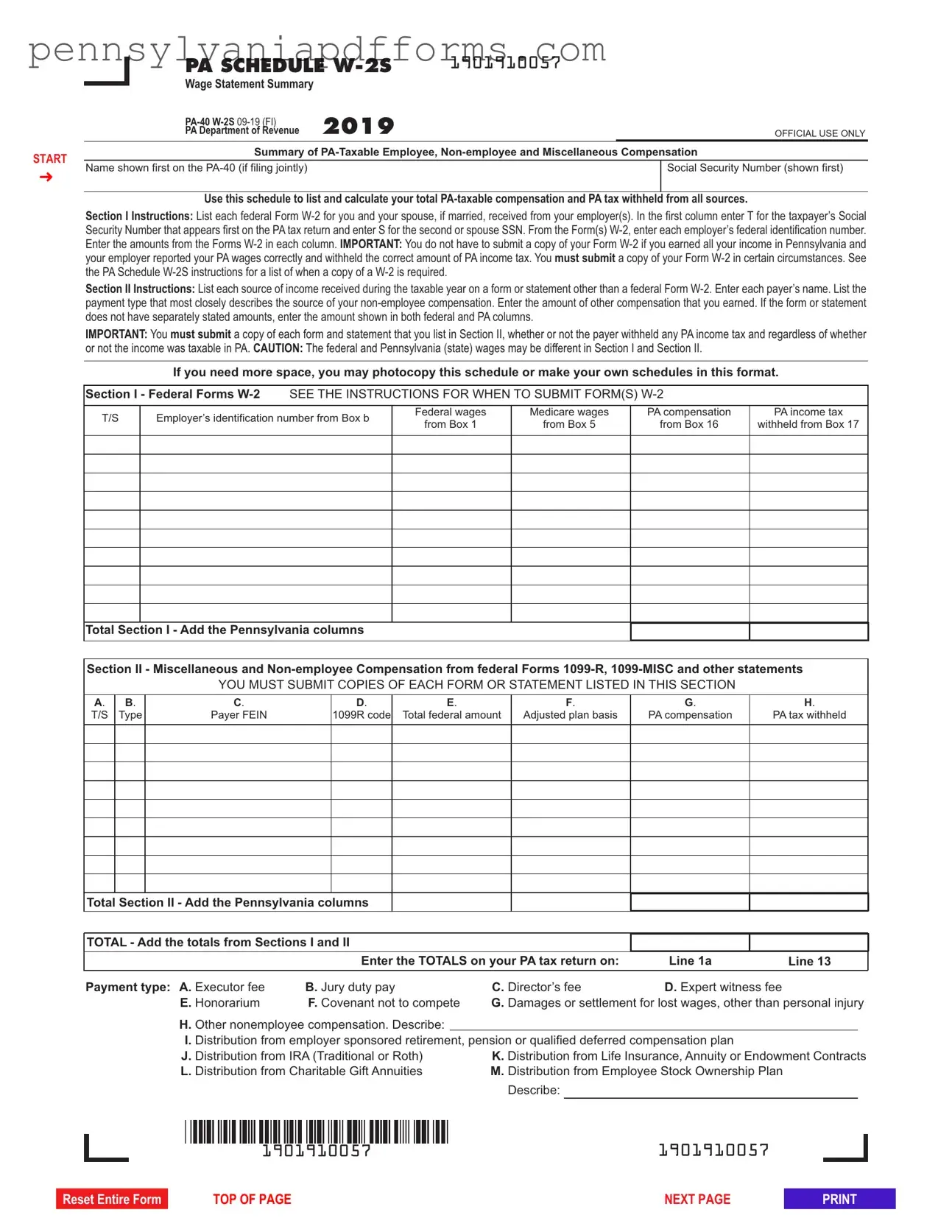

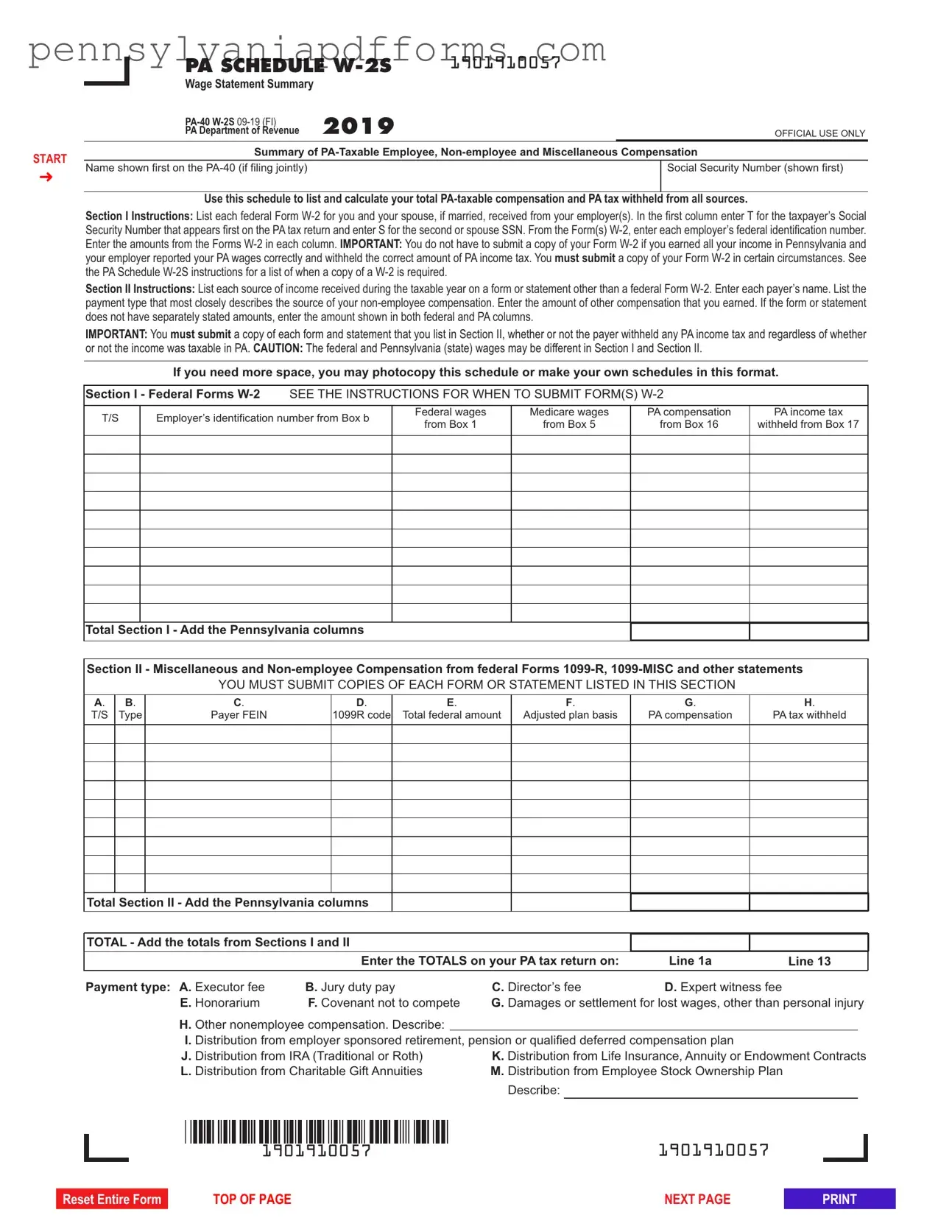

The PA W-2S form serves as a summary of wage statements, similar to the IRS Form W-2. The W-2 is issued by employers to report an employee's annual wages and the taxes withheld from their paycheck. Like the PA W-2S, the W-2 provides detailed information about the employee's earnings and tax contributions. However, the W-2 is a federal form, while the PA W-2S is specifically designed for Pennsylvania state income tax purposes. Both forms require accurate reporting of compensation and tax withheld, ensuring that employees can correctly file their tax returns.

Another document akin to the PA W-2S is the IRS Form 1099-MISC. This form is used to report various types of income that are not classified as wages, salaries, or tips. Similar to the PA W-2S, the 1099-MISC captures non-employee compensation, such as payments to independent contractors. Both forms require the reporting of income and may necessitate the submission of copies when filing tax returns. However, the 1099-MISC is primarily for reporting income from sources other than employment, while the PA W-2S focuses on compensation received from employment and other miscellaneous sources.

The New York Operating Agreement is a document that outlines the management structure and operating procedures for a limited liability company (LLC) in New York. This agreement is crucial for defining the roles and responsibilities of the members and can help prevent disputes in the future. Understanding this form is essential for anyone looking to establish an LLC in New York, and for those seeking guidance, resources such as PDF Document Service can be invaluable.

The IRS Form 1099-R is another document that shares similarities with the PA W-2S. This form is used to report distributions from pensions, annuities, retirement plans, and IRAs. Like the PA W-2S, the 1099-R requires taxpayers to report income received from these sources, including any taxes withheld. Both forms serve to ensure that taxpayers accurately report their income for tax purposes. However, while the PA W-2S includes both employee compensation and non-employee income, the 1099-R specifically addresses retirement distributions.

Form 1099-NEC, which reports non-employee compensation, is also comparable to the PA W-2S. Introduced in 2020, the 1099-NEC specifically focuses on payments made to independent contractors and freelancers. Both forms aim to provide a clear summary of income received outside of traditional employment. While the PA W-2S encompasses a broader range of compensation types, including miscellaneous and non-employee income, the 1099-NEC is dedicated solely to non-employee compensation.

The PA Schedule C is another relevant document, particularly for self-employed individuals. This form is used to report income and expenses from a business operated by the taxpayer. Like the PA W-2S, the Schedule C requires detailed reporting of income earned. However, while the PA W-2S summarizes wages and various types of compensation, the Schedule C focuses on business income and associated deductions, highlighting the differences in their respective purposes.

Form 1040, the U.S. Individual Income Tax Return, is also related to the PA W-2S. This form is used by individuals to file their annual income tax returns, reporting all sources of income, including wages, self-employment income, and retirement distributions. Similar to the PA W-2S, the Form 1040 requires taxpayers to report their total income and tax withheld. However, the Form 1040 is a comprehensive document that encompasses all income types, while the PA W-2S specifically addresses Pennsylvania taxable compensation.

Lastly, the PA-40 form, which is the Pennsylvania Personal Income Tax Return, is closely related to the PA W-2S. The PA-40 is the primary document used to report income earned in Pennsylvania and calculate state taxes owed. The PA W-2S provides essential information needed to complete the PA-40, summarizing taxable compensation and taxes withheld from various sources. While both forms serve the purpose of ensuring accurate tax reporting, the PA W-2S acts as a supporting document for the PA-40, focusing specifically on wage statements and compensation details.

R is not known, contact the payer for more information regarding the distribution to properly report the type of pay- ment. For distributions from an IRA, the box next to Box 7 on the

R is not known, contact the payer for more information regarding the distribution to properly report the type of pay- ment. For distributions from an IRA, the box next to Box 7 on the