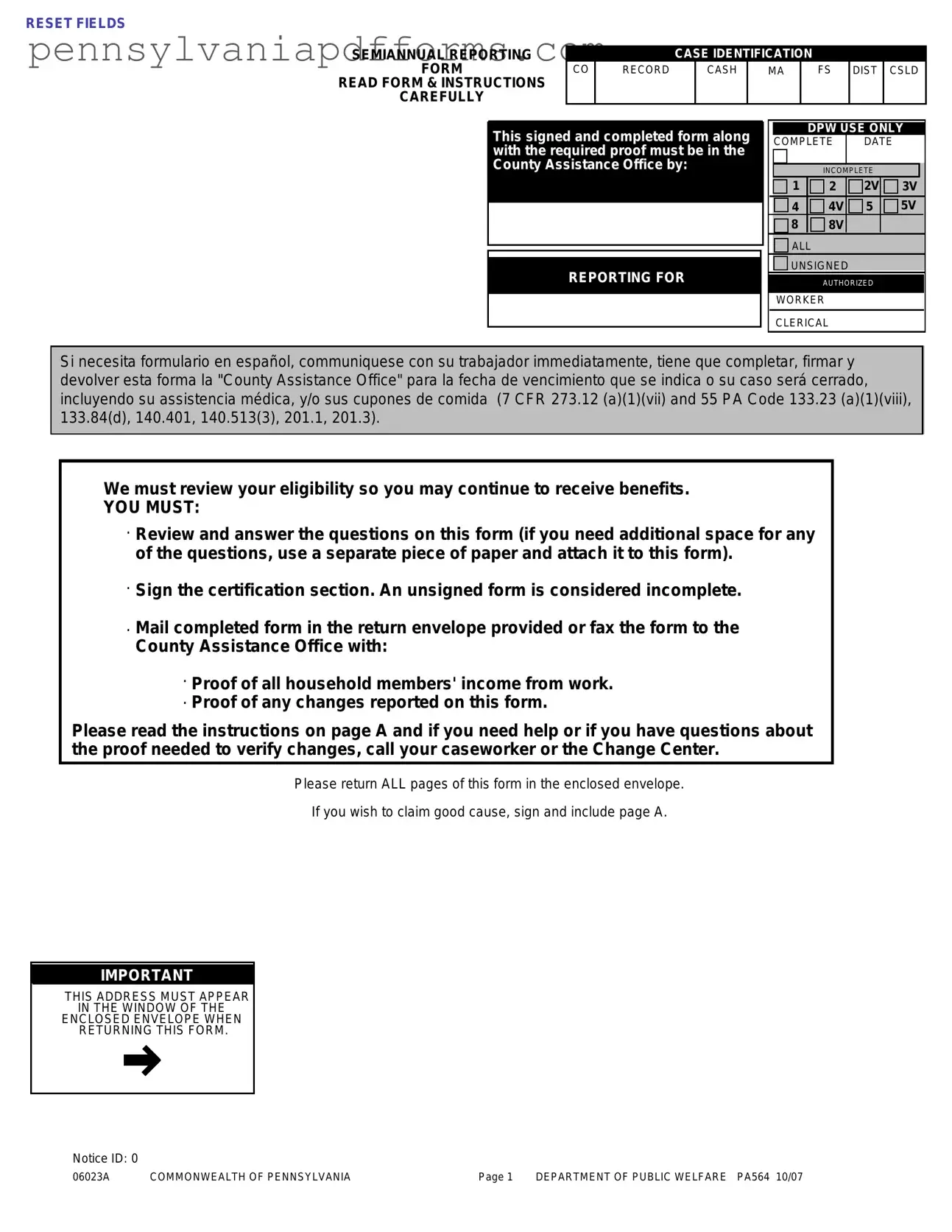

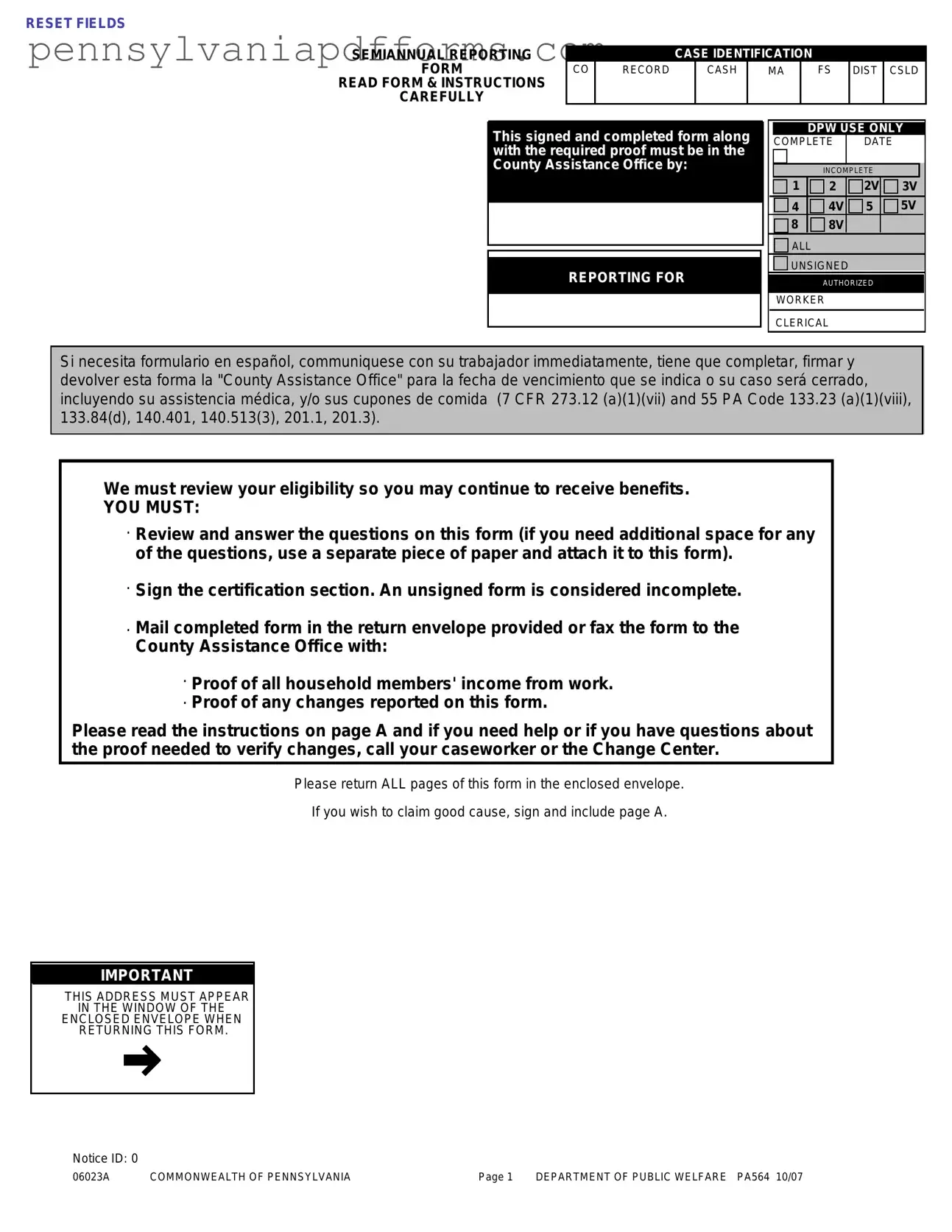

The PA564 form is essential for individuals receiving assistance from the Pennsylvania Department of Public Welfare. It is similar to the SNAP (Supplemental Nutrition Assistance Program) application. Both documents require detailed information about household income, expenses, and changes in circumstances. They serve to determine eligibility for benefits, ensuring that recipients receive the correct amount of assistance based on their current situation. The SNAP application also emphasizes the importance of providing proof of income and changes, just as the PA564 does.

Another comparable document is the TANF (Temporary Assistance for Needy Families) application. Like the PA564, the TANF application requires applicants to report their household composition and income sources. Both forms aim to assess eligibility for financial assistance, focusing on the applicant's current financial status. Additionally, they require documentation to verify the information provided, ensuring that assistance is allocated appropriately based on need.

The Medicaid application also shares similarities with the PA564 form. Both documents require individuals to provide information about their household members, income, and resources. The primary goal of the Medicaid application is to determine eligibility for health coverage, much like the PA564 assesses eligibility for cash and food assistance. Both forms emphasize the need for accurate reporting and documentation of any changes in circumstances that could affect eligibility.

The New York Trailer Bill of Sale serves as a pivotal document in the world of trailer ownership transfers by officially recording the exchange between parties. Similar to other essential forms, this Bill of Sale includes critical information including buyer and seller identities, trailer specifications, and the agreed-upon sale price. For further assistance in navigating these types of legal documents, the PDF Document Service is an excellent resource to help streamline the process and provide necessary templates.

The LIHEAP (Low-Income Home Energy Assistance Program) application is another document that resembles the PA564 form. Both require applicants to disclose household income and any changes that may impact their eligibility for assistance. LIHEAP focuses specifically on helping low-income households with their heating and cooling costs, while the PA564 addresses broader financial assistance needs. Nonetheless, both forms require proof of income and any relevant changes to ensure that assistance is provided fairly and accurately.

The WIC (Women, Infants, and Children) program application also shares similarities with the PA564. Both documents require applicants to provide information about household composition and income levels. The WIC application specifically targets nutritional assistance for pregnant women and young children, while the PA564 encompasses a wider range of assistance programs. However, both require proof of income and emphasize the importance of accurate reporting to maintain eligibility.

The unemployment benefits application is another document that aligns with the PA564 form. Both require individuals to report their current employment status and any changes in income. The unemployment application focuses on providing temporary financial support to those who have lost their jobs, while the PA564 assesses eligibility for various forms of assistance. Both forms stress the importance of timely and accurate information to ensure that benefits are distributed correctly.

The Social Security Disability Insurance (SSDI) application is similar in that it also requires detailed information about an individual's financial situation and household composition. Both the SSDI application and the PA564 form seek to determine eligibility for benefits based on current circumstances. They require documentation to verify income and any changes, reinforcing the need for accurate reporting to maintain eligibility for assistance.

The Child Support Enforcement application shares similarities with the PA564 form, particularly in how both documents require reporting on household income and changes in financial circumstances. The Child Support Enforcement application focuses on ensuring that non-custodial parents fulfill their financial obligations to their children, while the PA564 assesses eligibility for various assistance programs. Both require proof of income and changes to ensure fair allocation of benefits.

Lastly, the housing assistance application is comparable to the PA564 form. Both documents require applicants to disclose household income and any changes in circumstances that may affect eligibility for assistance. The housing assistance application focuses on providing support for rent or mortgage payments, while the PA564 addresses a broader range of assistance needs. Both forms emphasize the importance of accurate reporting and documentation to ensure that individuals receive the appropriate level of assistance.