The Pennsylvania Board of Appeals petition form shares similarities with the IRS Form 843, which is used to claim a refund or request an abatement of certain taxes. Both documents require detailed information about the taxpayer, including their identification and tax account numbers. They also necessitate a clear statement of the reason for the request, whether it is for a refund or an abatement. In both cases, the taxpayer must certify the accuracy of the information provided and may need to attach supporting documentation to substantiate their claims.

Another comparable document is the California Board of Equalization Petition for Redetermination, which allows taxpayers to contest tax assessments. Like the Pennsylvania form, this document requires taxpayers to specify the type of tax being contested and the period in question. Both forms also ask for a description of the issues involved and provide a space for taxpayers to outline their arguments. The need for signatures and certifications of truthfulness is a common feature, ensuring accountability in the claims made.

The New York State Tax Appeals Tribunal’s Petition for Review form is also similar. It allows taxpayers to appeal decisions made by the Department of Taxation and Finance. This form, like the Pennsylvania petition, requires the taxpayer to provide their identification details, the tax type, and the assessment amount. Both forms emphasize the importance of a detailed explanation of the reasons for the appeal and require the taxpayer's signature to validate the petition.

In Texas, the Notice of Appeal form serves a similar purpose. It allows taxpayers to challenge property tax appraisals. Much like the Pennsylvania form, it requires the appellant to provide relevant identification information and specifics about the contested assessment. Both documents emphasize the need for a clear statement of the grounds for the appeal and the requirement for signatures to confirm the authenticity of the submissions.

The Florida Department of Revenue's Petition for Administrative Hearing is another document that resembles the Pennsylvania form. This petition is used to contest tax assessments or denials. Both forms require the taxpayer to identify the tax type and provide a thorough explanation of the issues being appealed. Additionally, they necessitate signatures from the petitioner or their authorized representative, underscoring the importance of accountability in the appeals process.

In the realm of rental agreements, it is essential to have clear documentation to avoid misunderstandings, much like the Ohio Residential Lease Agreement form, which stipulates the responsibilities and rights of landlords and tenants. This form serves as a valuable reference for anyone looking to navigate the complexities of property rental. For further insights into the specifics of such agreements, you can explore https://topformsonline.com/ohio-residential-lease-agreement/.

The Illinois Department of Revenue’s Request for Hearing form is also similar. It allows taxpayers to request a hearing on tax assessments or denials. Both forms require the taxpayer to provide identification and details about the tax period in question. They also demand a concise explanation of the issues involved and require signatures to affirm the accuracy of the information provided.

Furthermore, the Massachusetts Appellate Tax Board Petition form mirrors the Pennsylvania form. This document is used to appeal property tax assessments. Like the Pennsylvania petition, it requires the taxpayer to provide their identification and specific details about the contested assessment. Both forms emphasize the necessity of a clear statement of the reasons for the appeal and the requirement for signatures to ensure the validity of the claims made.

Lastly, the Ohio Board of Tax Appeals form for filing a notice of appeal is similar in nature. This document is used to contest various tax assessments. Both the Ohio form and the Pennsylvania petition require the taxpayer to provide identification details, the type of tax involved, and a comprehensive explanation of the appeal's basis. The need for signatures to certify the truthfulness of the information is a common requirement in both documents, reinforcing the importance of integrity in the appeals process.

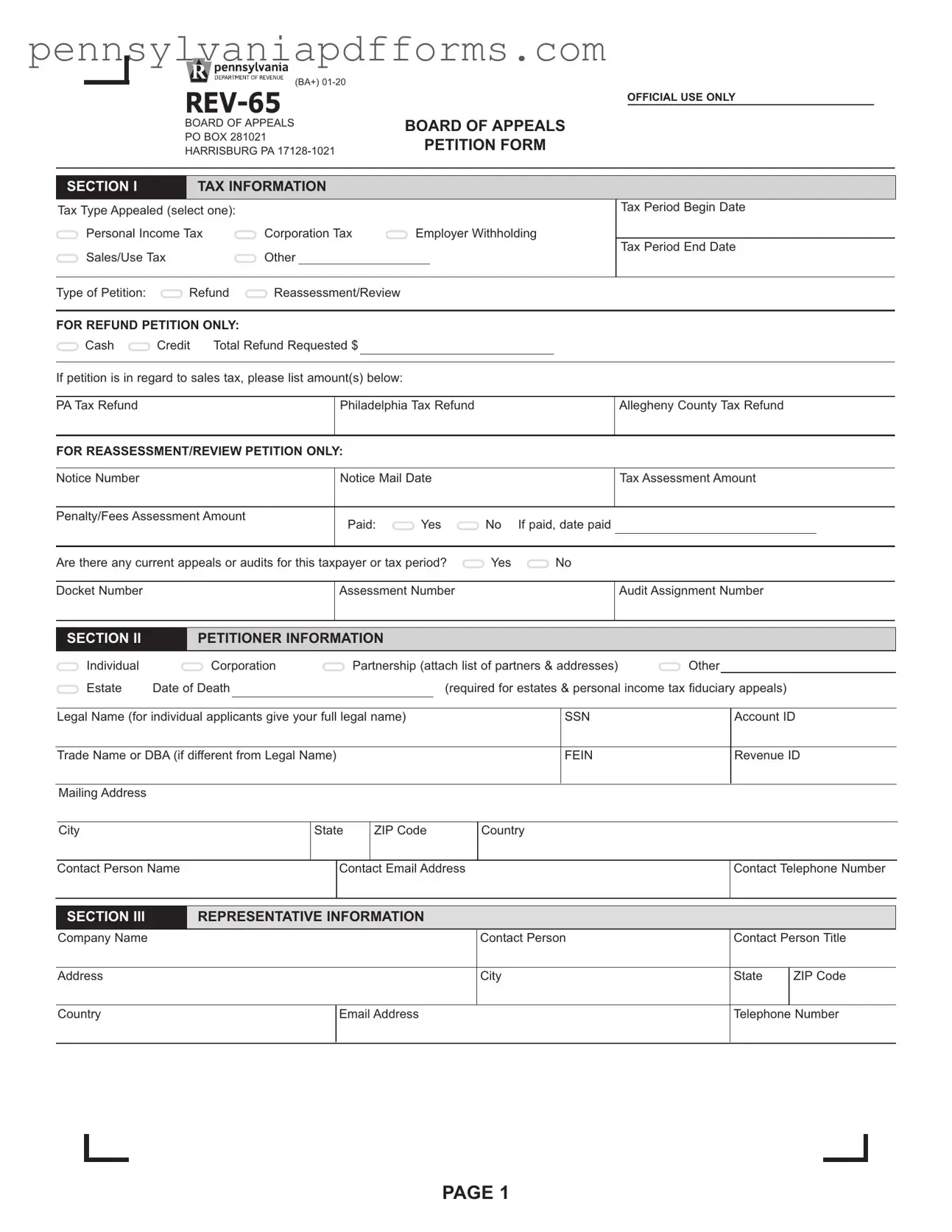

(BA+)

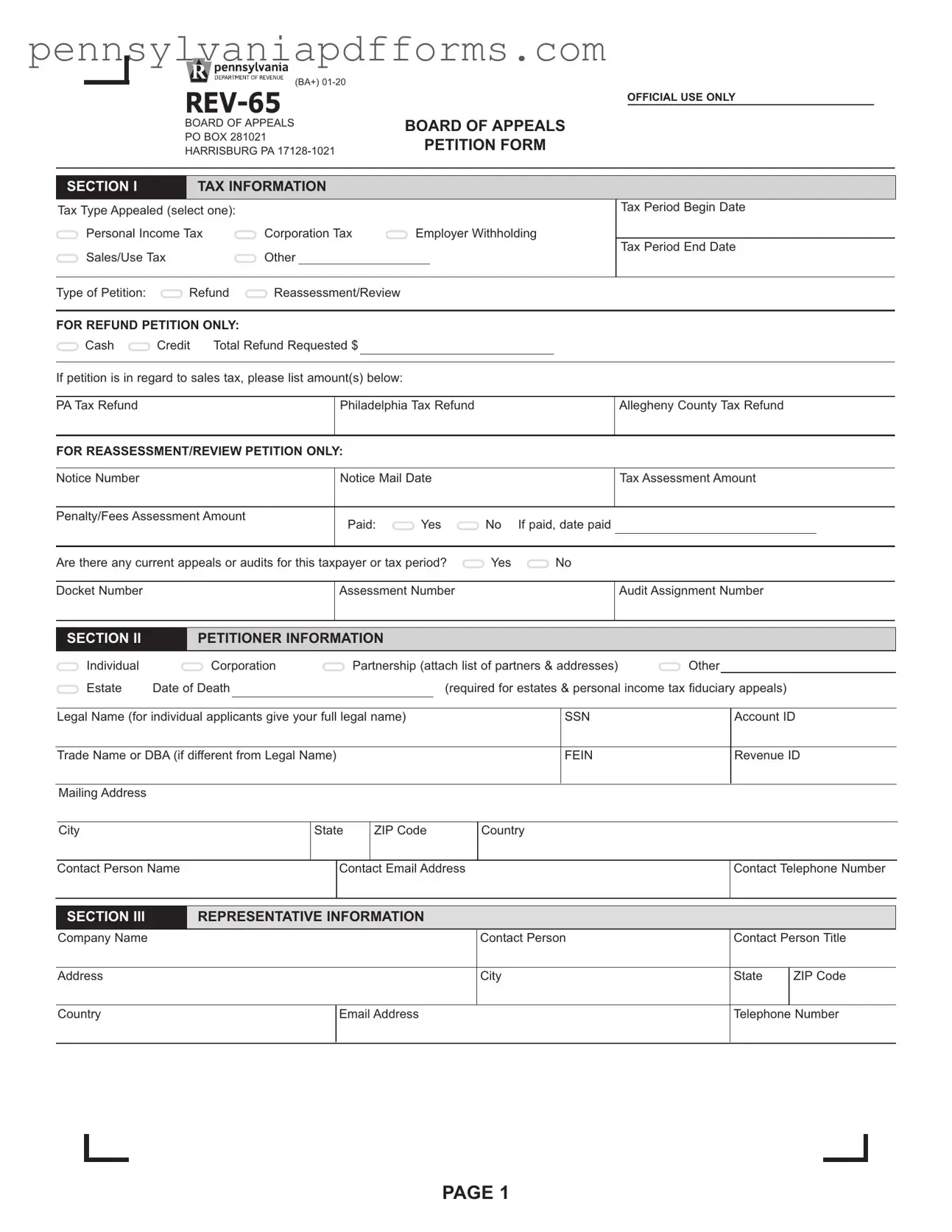

(BA+)  V

V

law, 42 U.S.C. § 405 (c), to use your Social Security number in administering state tax law.The department uses your Social Security number to establish your identity and to process your appeal.

law, 42 U.S.C. § 405 (c), to use your Social Security number in administering state tax law.The department uses your Social Security number to establish your identity and to process your appeal.

decision and order, may be transmitted to you or your representative via email, should you elect the email option. If you elect to receive communications via email, you and your representatives assume the responsibility for the confidentiality of the information contained in emails sent to and from the Board ofAppeals. The commonwealth will not be held liable for the disclosure of any confidential information sent via email.

decision and order, may be transmitted to you or your representative via email, should you elect the email option. If you elect to receive communications via email, you and your representatives assume the responsibility for the confidentiality of the information contained in emails sent to and from the Board ofAppeals. The commonwealth will not be held liable for the disclosure of any confidential information sent via email.