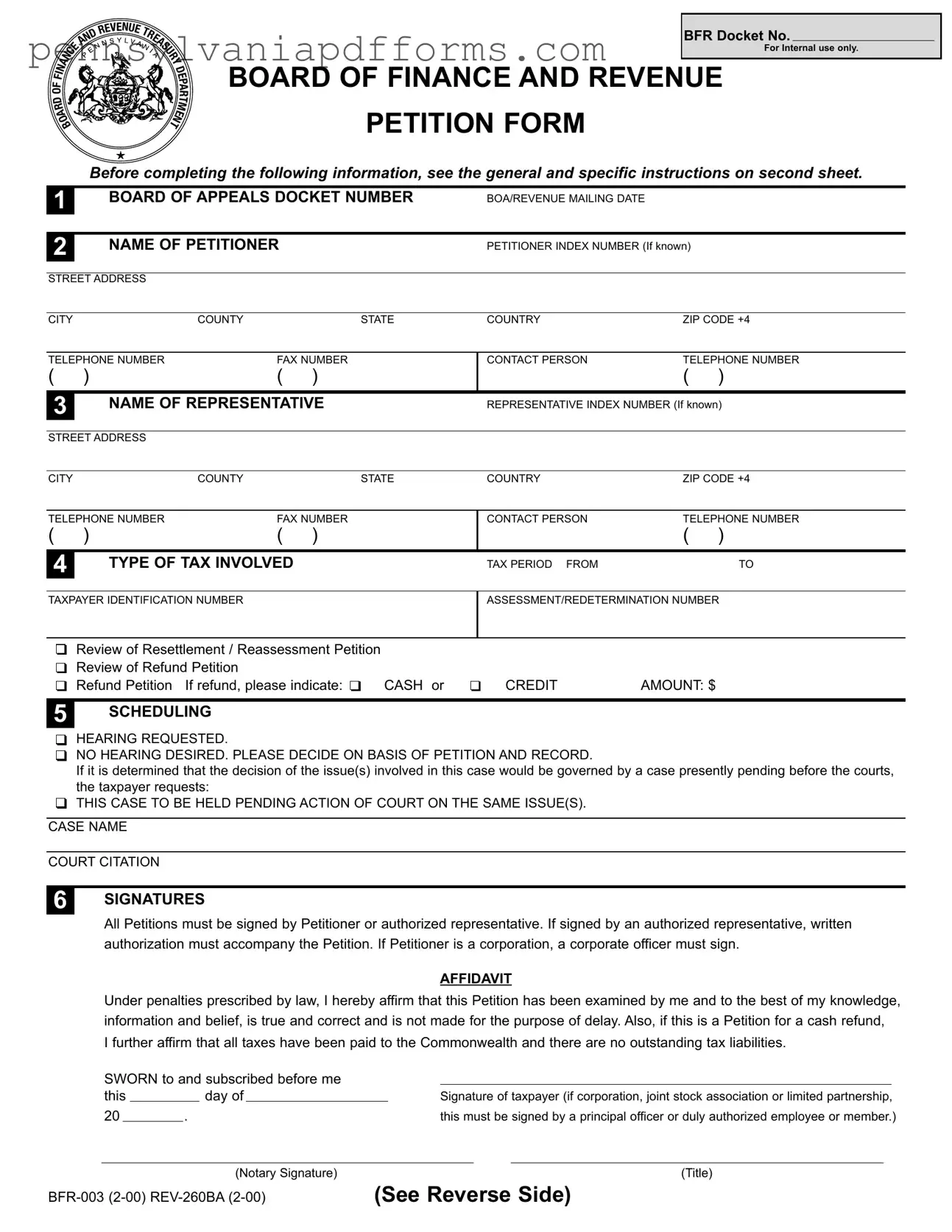

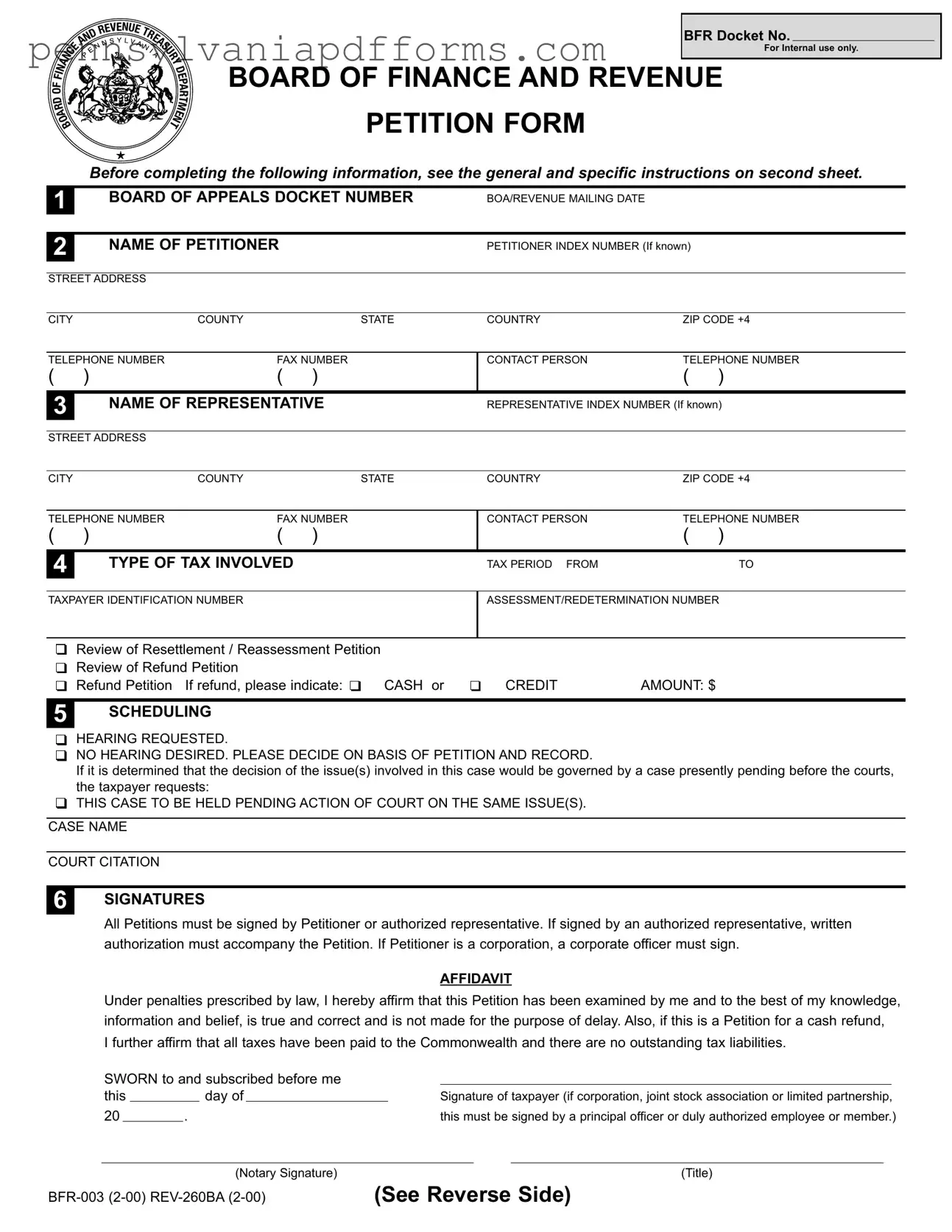

Pennsylvania Bfr 003 Form

The Pennsylvania BFR 003 form is a petition form used to appeal decisions made by the Board of Appeals or to request a refund of taxes. It is essential for taxpayers who believe they have been wrongfully assessed or who seek to reclaim funds paid to the state. Completing this form accurately is crucial for a successful appeal or refund request, so take the time to fill it out carefully.

If you're ready to take action, click the button below to fill out the form.

Access Editor Now

Pennsylvania Bfr 003 Form

Access Editor Now

Almost there — finish the form

Complete Pennsylvania Bfr 003 online in minutes, fully online.

Access Editor Now

or

➤ Pennsylvania Bfr 003 File