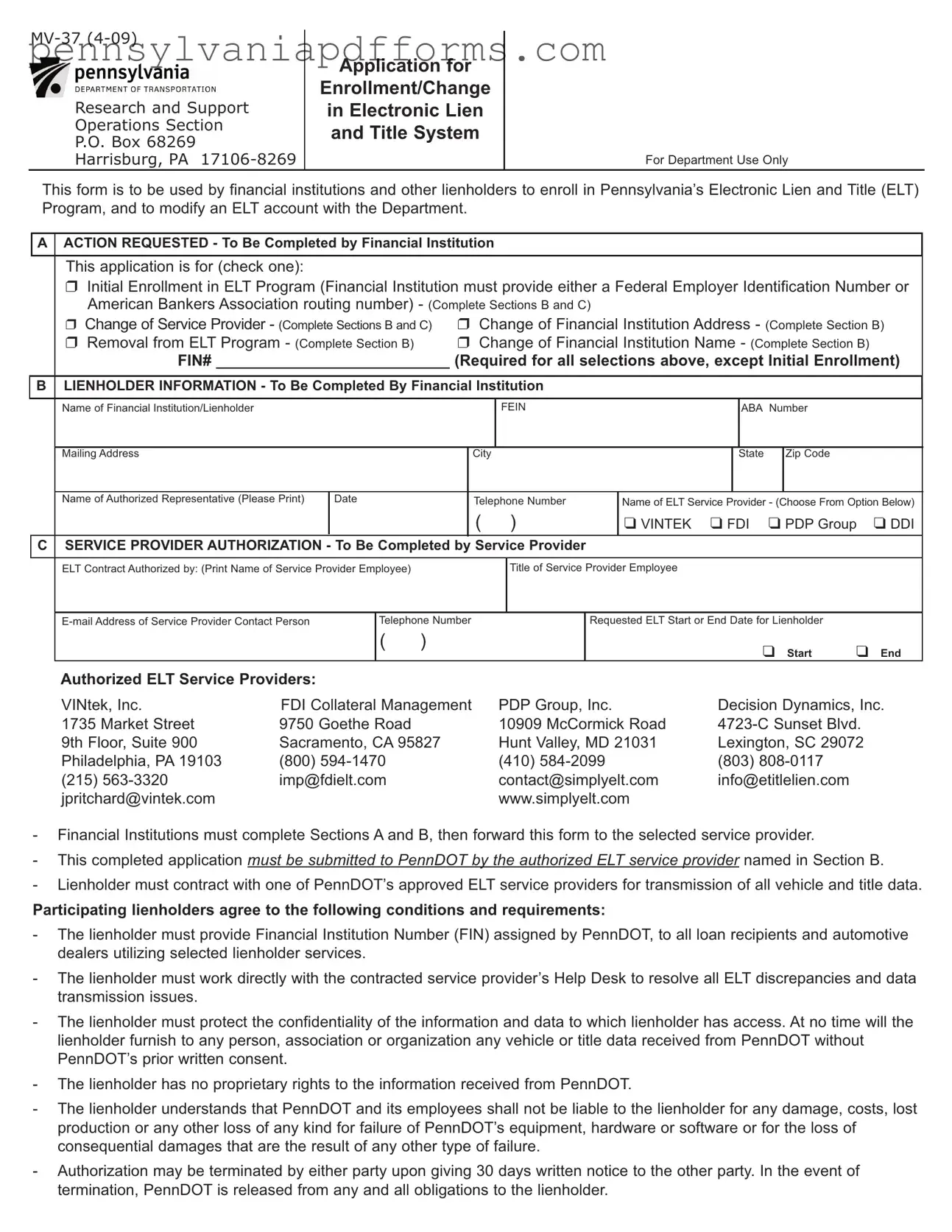

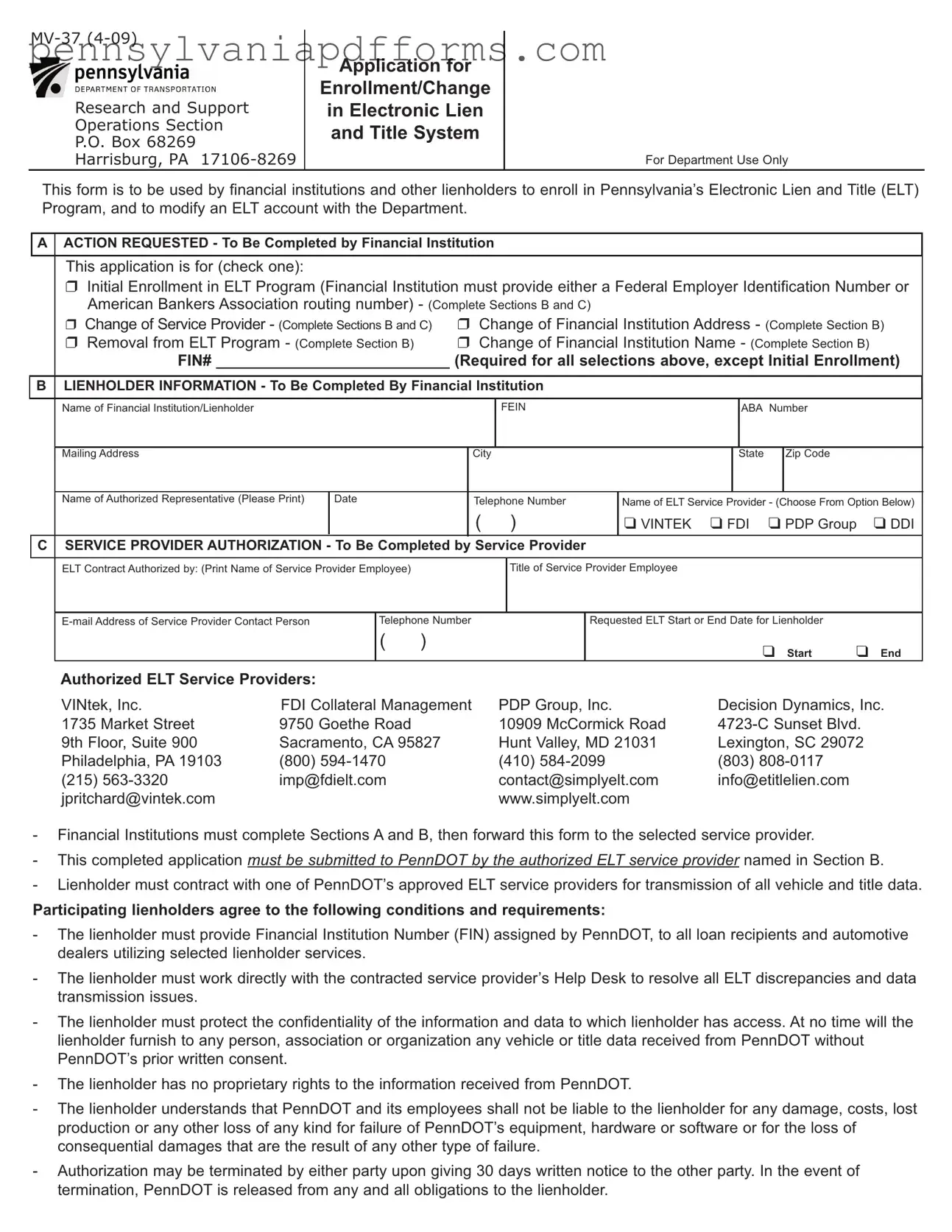

This form is to be used by financial institutions and other lienholders to enroll in Pennsylvania’s Electronic Lien and Title (ELT) Program, and to modify an ELT account with the Department.

AACTIONREQUESTED - ToBeCompletedbyFinancialInstitution

This application is for (check one):

❒Initial Enrollment in ELT Program (Financial Institution must provide either a Federal Employer Identification Number or American BankersAssociation routing number) - (Complete Sections B and C)

❒ChangeofServiceProvider-(CompleteSectionsBandC) ❒ Change of Financial InstitutionAddress - (Complete Section B)

❒Removal from ELT Program - (Complete Section B) ❒ Change of Financial Institution Name - (Complete Section B)

FIN# ___________________________ (Required for all selectionsabove,exceptInitialEnrollment)

BLIENHOLDERINFORMATION - ToBeCompletedByFinancialInstitution

|

Name of Financial Institution/Lienholder |

|

|

|

|

|

FEIN |

|

|

|

ABA |

Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MailingAddress |

|

|

|

|

City |

|

|

|

|

|

|

State |

|

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name ofAuthorized Representative (Please Print) |

Date |

|

Telephone Number |

NameofELTServiceProvider - (ChooseFromOptionBelow) |

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

❑VINTEK |

❑FDI |

❑PDP Group ❑DDI |

|

|

|

|

|

|

|

|

|

|

|

|

|

C SERVICEPROVIDERAUTHORIZATION - ToBeCompletedbyServiceProvider |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ELTContractAuthorizedby:(PrintNameofServiceProviderEmployee) |

|

|

|

TitleofServiceProviderEmployee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E-mailAddressofServiceProviderContactPerson |

|

TelephoneNumber |

|

|

RequestedELTStartorEndDateforLienholder |

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

❑ Start |

❑ End |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AuthorizedELTServiceProviders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VINtek, Inc. |

FDI Collateral Management |

PDP Group, Inc. |

|

Decision Dynamics, Inc. |

|

1735 Market Street |

9750 Goethe Road |

|

|

10909 McCormick Road |

4723-C Sunset Blvd. |

|

9th Floor, Suite 900 |

Sacramento, CA95827 |

Hunt Valley, MD 21031 |

Lexington, SC 29072 |

|

Philadelphia, PA19103 |

(800) 594-1470 |

|

|

(410) 584-2099 |

|

(803) 808-0117 |

|

(215) 563-3320 |

imp@fdielt.com |

|

|

contact@simplyelt.com |

info@etitlelien.com |

|

|

jpritchard@vintek.com |

|

|

|

|

|

www.simplyelt.com |

|

|

|

|

|

|

-Financial Institutions must complete SectionsAand B, then forward this form to the selected service provider.

-This completed application must be submitted to PennDOT by the authorized ELT service provider named in Section B.

-LienholdermustcontractwithoneofPennDOT’sapprovedELTserviceprovidersfortransmissionofallvehicleandtitledata.

Participatinglienholdersagreetothefollowingconditionsandrequirements:

-ThelienholdermustprovideFinancialInstitutionNumber(FIN)assignedbyPennDOT,toallloanrecipientsandautomotive

dealersutilizingselectedlienholderservices.

-Thelienholdermustworkdirectlywiththecontractedserviceprovider’sHelpDesktoresolveallELTdiscrepanciesanddata

transmissionissues.

-Thelienholdermustprotecttheconfidentialityoftheinformationanddatatowhichlienholderhasaccess.Atnotimewillthe lienholderfurnishtoanyperson,associationororganizationanyvehicleortitledatareceivedfromPennDOTwithout PennDOT’spriorwrittenconsent.

-ThelienholderhasnoproprietaryrightstotheinformationreceivedfromPennDOT.

-ThelienholderunderstandsthatPennDOTanditsemployeesshallnotbeliabletothelienholderforanydamage,costs,lost

productionoranyotherlossofanykindforfailureofPennDOT’sequipment,hardwareorsoftwareorforthelossof

consequentialdamagesthataretheresultofanyothertypeoffailure.

-Authorizationmaybeterminatedbyeitherpartyupongiving30dayswrittennoticetotheotherparty. Intheeventof termination,PennDOTisreleasedfromanyandallobligationstothelienholder.