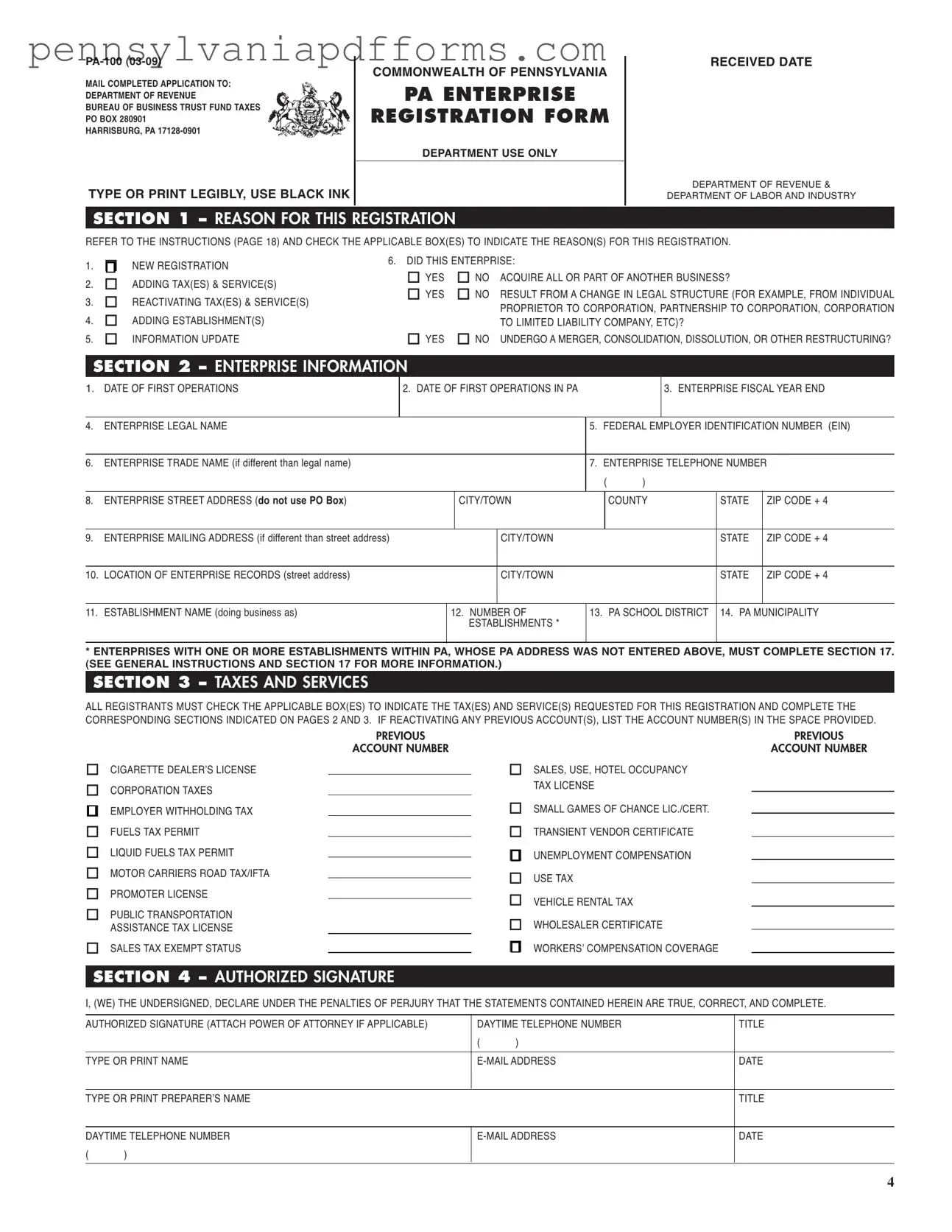

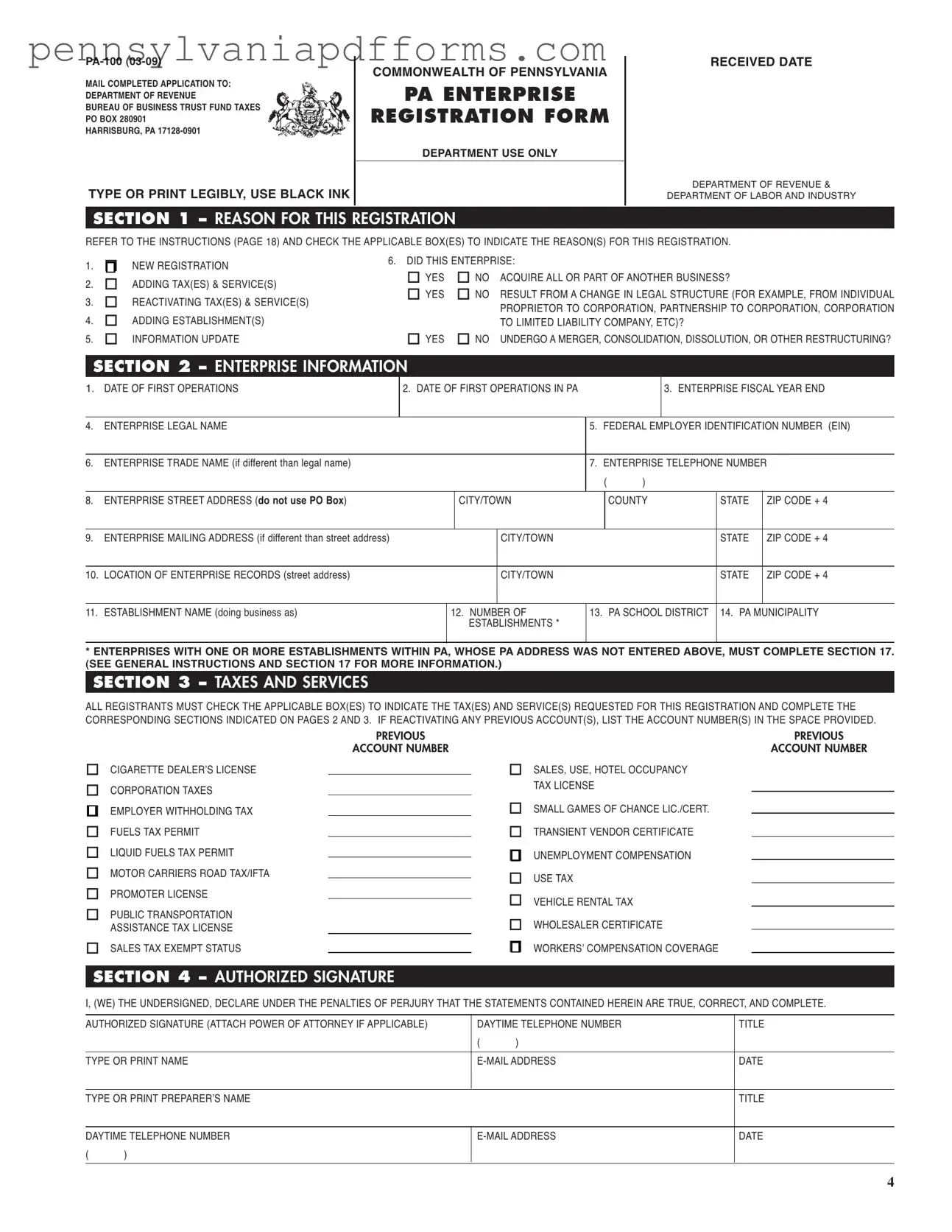

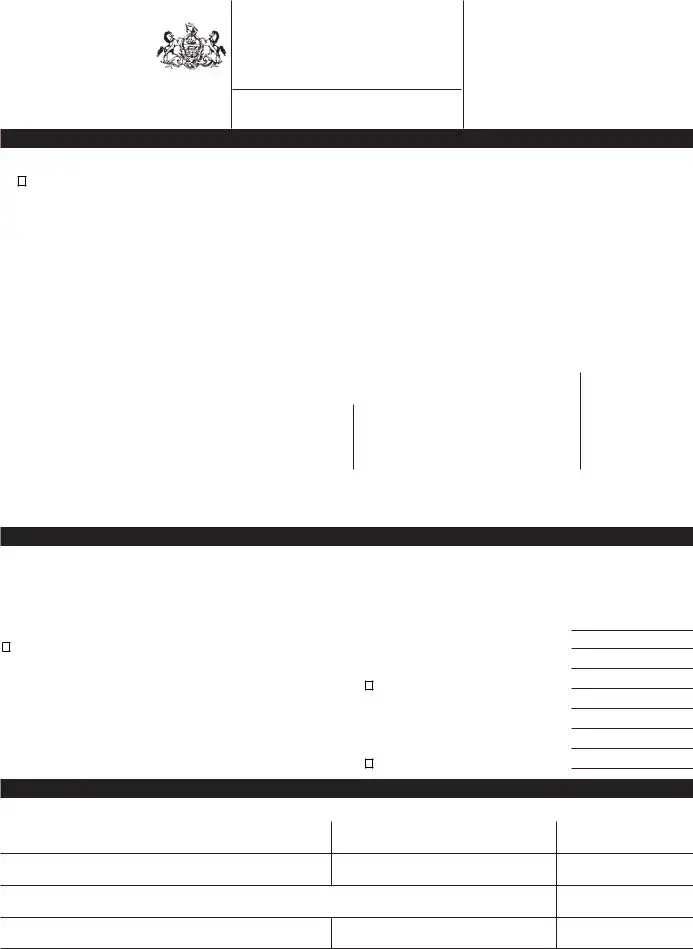

The Pennsylvania PA-100 form is an essential document for businesses registering with the state. It shares similarities with the IRS Form SS-4, which is used to apply for an Employer Identification Number (EIN). Both forms require detailed information about the business structure, ownership, and purpose. The PA-100 focuses on state-specific tax registration, while the SS-4 is aimed at federal tax identification. Completing both forms is crucial for compliance with tax regulations at both state and federal levels.

Another document similar to the PA-100 is the IRS Form 1065, which is used for partnerships to report income, deductions, and other tax information. Like the PA-100, Form 1065 requires information about the business entity, including its structure and ownership. While the PA-100 is primarily for registration purposes, Form 1065 is utilized for annual tax reporting. Both forms serve as vital tools for ensuring proper tax compliance and reporting.

The PA-100 is also comparable to the Pennsylvania Sales Tax License Application. Both documents require businesses to provide detailed information about their operations and ownership. The Sales Tax License Application specifically focuses on the collection of sales tax, while the PA-100 encompasses a broader range of tax registrations. Businesses must complete both to operate legally within Pennsylvania and fulfill their tax obligations.

Another related document is the IRS Form 2553, which is used by corporations to elect S Corporation status. Both the PA-100 and Form 2553 require information about the business structure and ownership. While the PA-100 is concerned with state registration, Form 2553 is focused on federal tax classification. Completing both forms is essential for businesses seeking specific tax treatments and benefits.

The PA-100 is also similar to the Pennsylvania LLC Registration form. Both documents require information about the business’s legal structure and ownership. The LLC Registration form is specifically for limited liability companies, while the PA-100 is more general. Both forms are crucial for establishing a business entity and ensuring compliance with state regulations.

Another document that aligns with the PA-100 is the IRS Form 941, which is used to report income taxes, Social Security tax, and Medicare tax withheld from employees' paychecks. Both forms require information about the business and its employees. While the PA-100 is focused on registration, Form 941 is used for ongoing tax reporting. Businesses must complete both to maintain compliance with tax laws.

The Pennsylvania Corporation Registration form is another document similar to the PA-100. Both forms require information about the business structure and ownership. The Corporation Registration form is specifically for corporations, while the PA-100 serves a broader audience. Both documents are essential for legal recognition and tax compliance within the state.

The PA-100 also resembles the IRS Form 1120, which is the U.S. Corporation Income Tax Return. Both documents require detailed financial information about the business. The PA-100 is focused on registration and tax obligations in Pennsylvania, while Form 1120 is used for federal tax reporting. Businesses must navigate both forms to ensure compliance with state and federal tax requirements.

Additionally, the Pennsylvania Nonprofit Corporation Application shares similarities with the PA-100. Both documents require information about the organization’s structure and purpose. The Nonprofit Corporation Application is specifically designed for nonprofit entities, while the PA-100 serves all types of businesses. Both forms are vital for establishing legal status and fulfilling tax obligations.

For those interested in the buying and selling process, the essential aspects of filling out a Dirt Bike Bill of Sale to ensure compliance cannot be overlooked. This form simplifies the transaction while protecting the rights of both parties involved.

Finally, the Pennsylvania Employee Withholding Tax Registration form is comparable to the PA-100. Both forms require information about the business and its employees. The Employee Withholding Tax Registration form specifically focuses on tax withholding responsibilities, while the PA-100 is more comprehensive. Completing both forms is essential for businesses to comply with state tax laws and regulations.

YES

YES