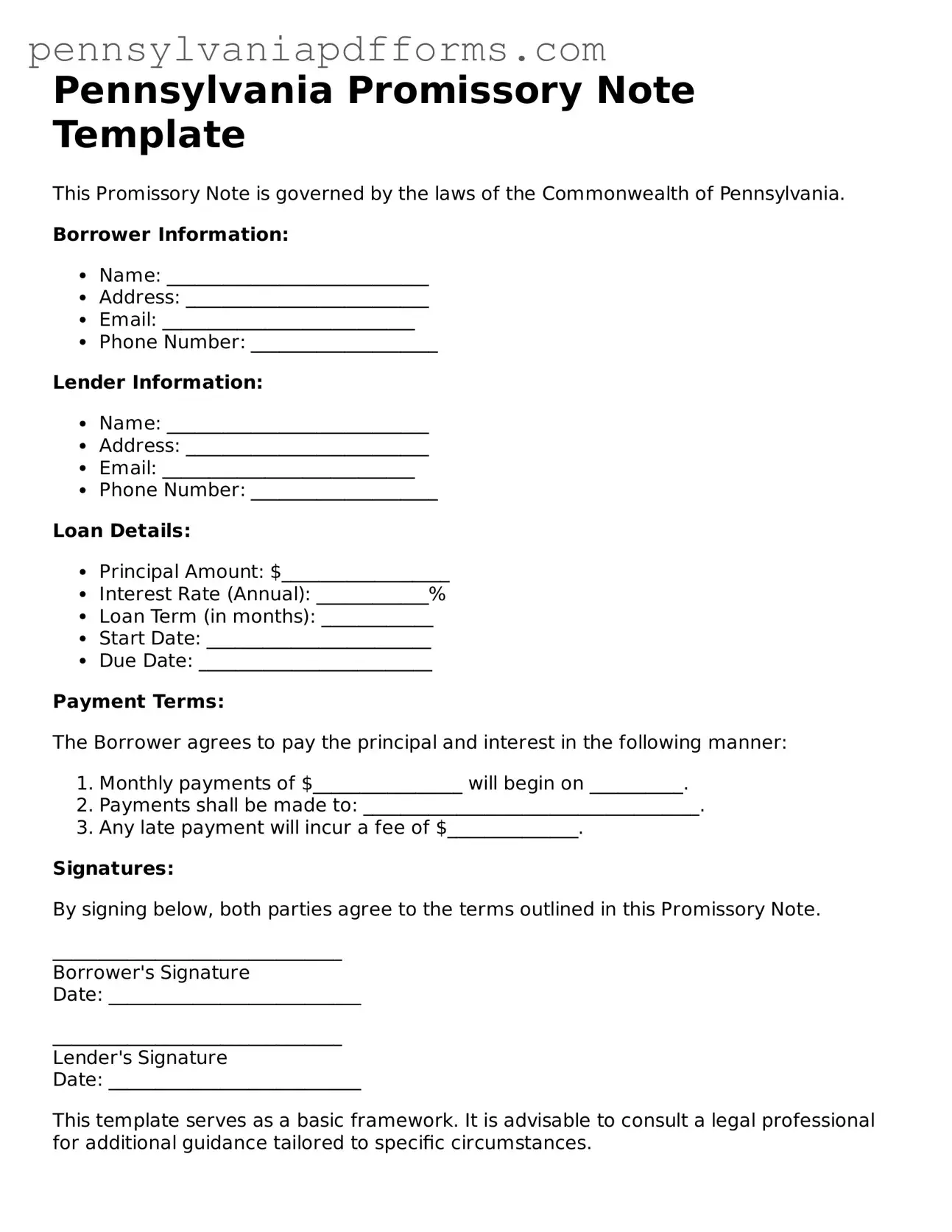

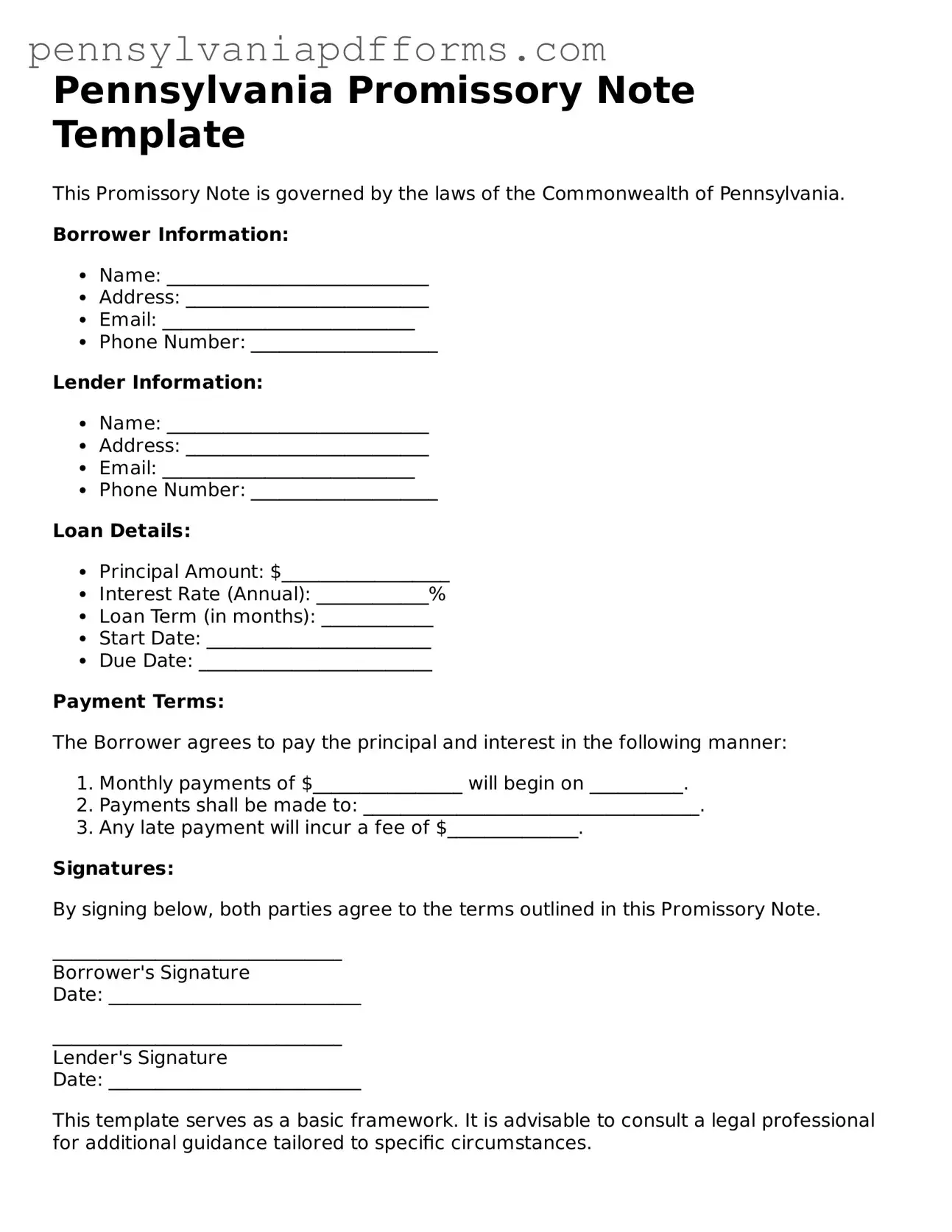

Fillable Promissory Note Document for Pennsylvania State

A Pennsylvania Promissory Note is a written promise where one party agrees to pay a specific amount of money to another party under agreed-upon terms. This document serves as a legal record of the debt, outlining the repayment schedule and any interest involved. If you need to formalize a loan agreement, consider filling out the form by clicking the button below.

Access Editor Now

Fillable Promissory Note Document for Pennsylvania State

Access Editor Now

Almost there — finish the form

Complete Promissory Note online in minutes, fully online.

Access Editor Now

or

➤ Promissory Note File