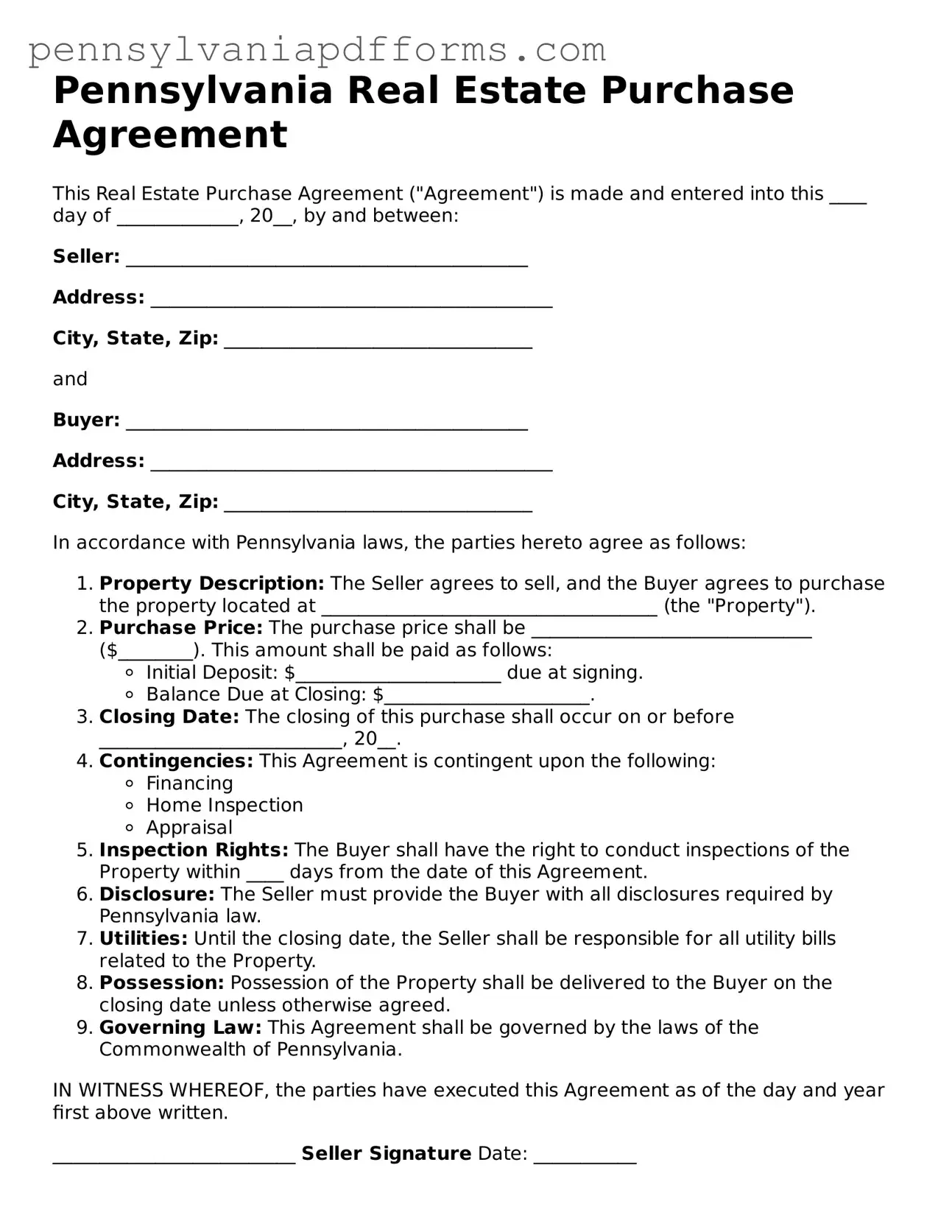

Fillable Real Estate Purchase Agreement Document for Pennsylvania State

The Pennsylvania Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions under which a property is bought and sold in Pennsylvania. This form serves as a crucial tool for both buyers and sellers, ensuring that all parties are clear on their obligations and rights throughout the transaction process. Understanding this agreement is essential for a smooth real estate experience, so take action now and fill out the form by clicking the button below.

Access Editor Now

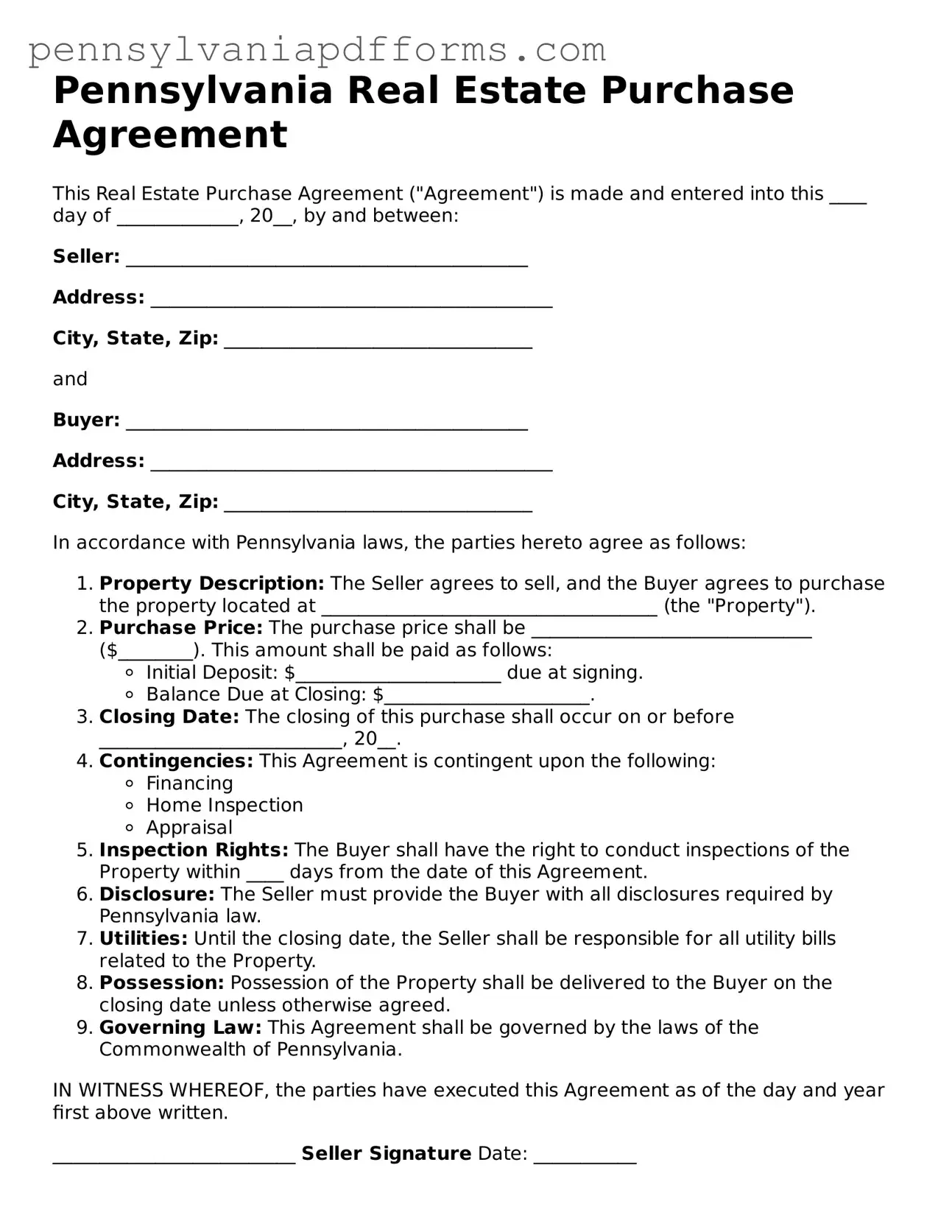

Fillable Real Estate Purchase Agreement Document for Pennsylvania State

Access Editor Now

Almost there — finish the form

Complete Real Estate Purchase Agreement online in minutes, fully online.

Access Editor Now

or

➤ Real Estate Purchase Agreement File