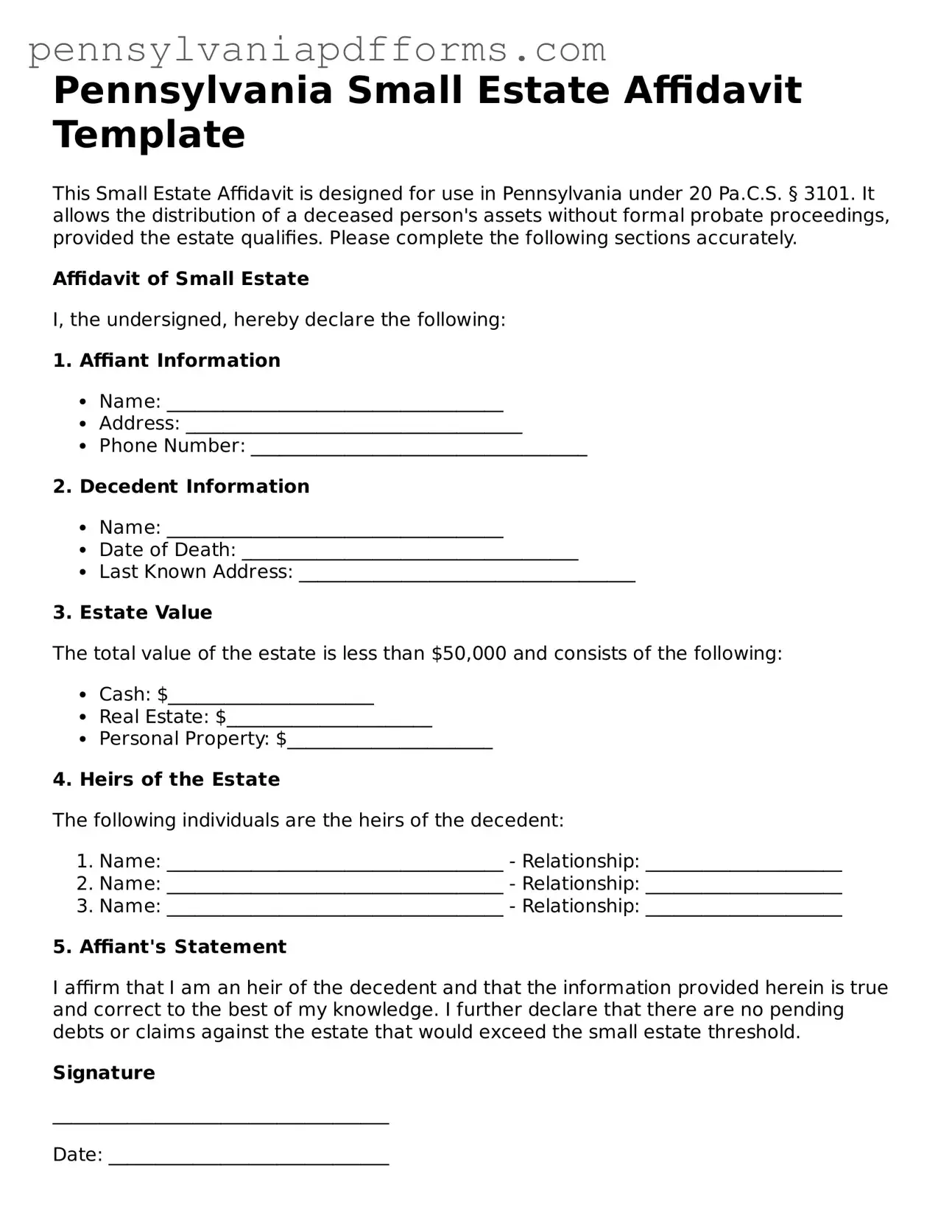

Fillable Small Estate Affidavit Document for Pennsylvania State

The Pennsylvania Small Estate Affidavit is a legal document that allows individuals to settle the estate of a deceased person without going through the lengthy probate process. This form is typically utilized when the total value of the estate falls below a specified threshold, making it a more efficient option for heirs. Understanding how to properly complete and submit this affidavit can simplify the estate settlement process.

To begin filling out the form, please click the button below.

Access Editor Now

Fillable Small Estate Affidavit Document for Pennsylvania State

Access Editor Now

Almost there — finish the form

Complete Small Estate Affidavit online in minutes, fully online.

Access Editor Now

or

➤ Small Estate Affidavit File