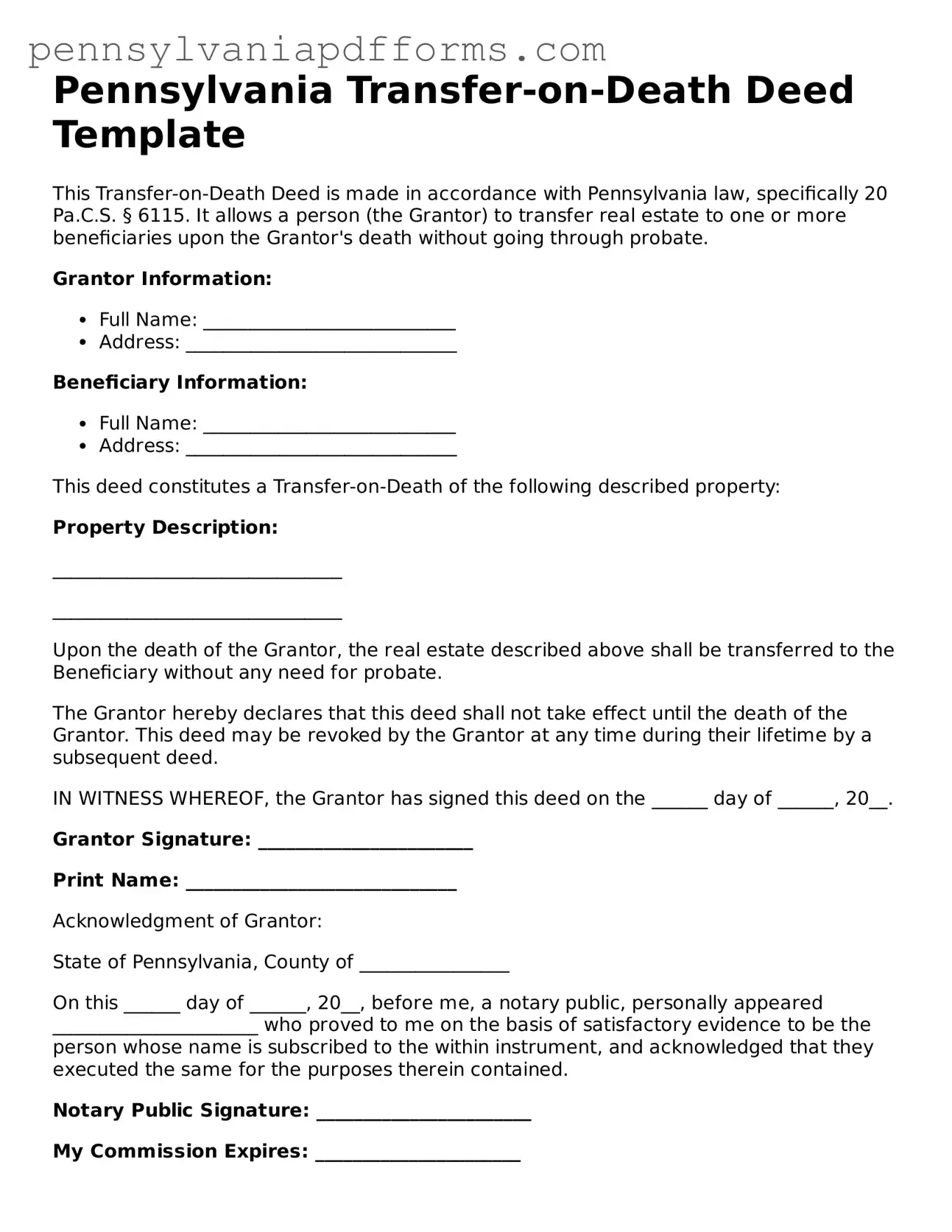

Fillable Transfer-on-Death Deed Document for Pennsylvania State

A Pennsylvania Transfer-on-Death Deed form allows property owners to designate beneficiaries who will inherit their real estate upon their passing, without the need for probate. This straightforward process can provide peace of mind and ensure that your wishes are honored. To get started on securing your property for your loved ones, fill out the form by clicking the button below.

Access Editor Now

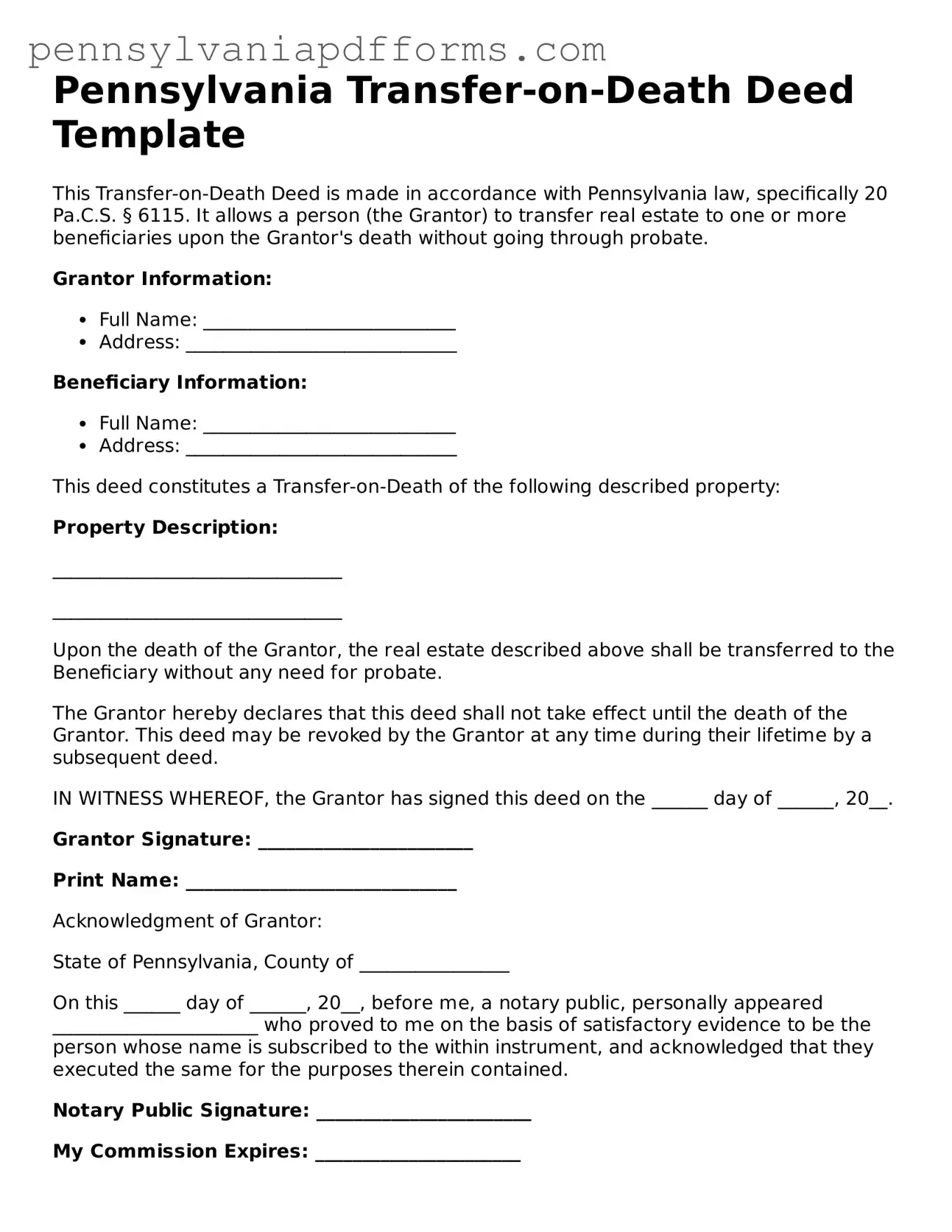

Fillable Transfer-on-Death Deed Document for Pennsylvania State

Access Editor Now

Almost there — finish the form

Complete Transfer-on-Death Deed online in minutes, fully online.

Access Editor Now

or

➤ Transfer-on-Death Deed File